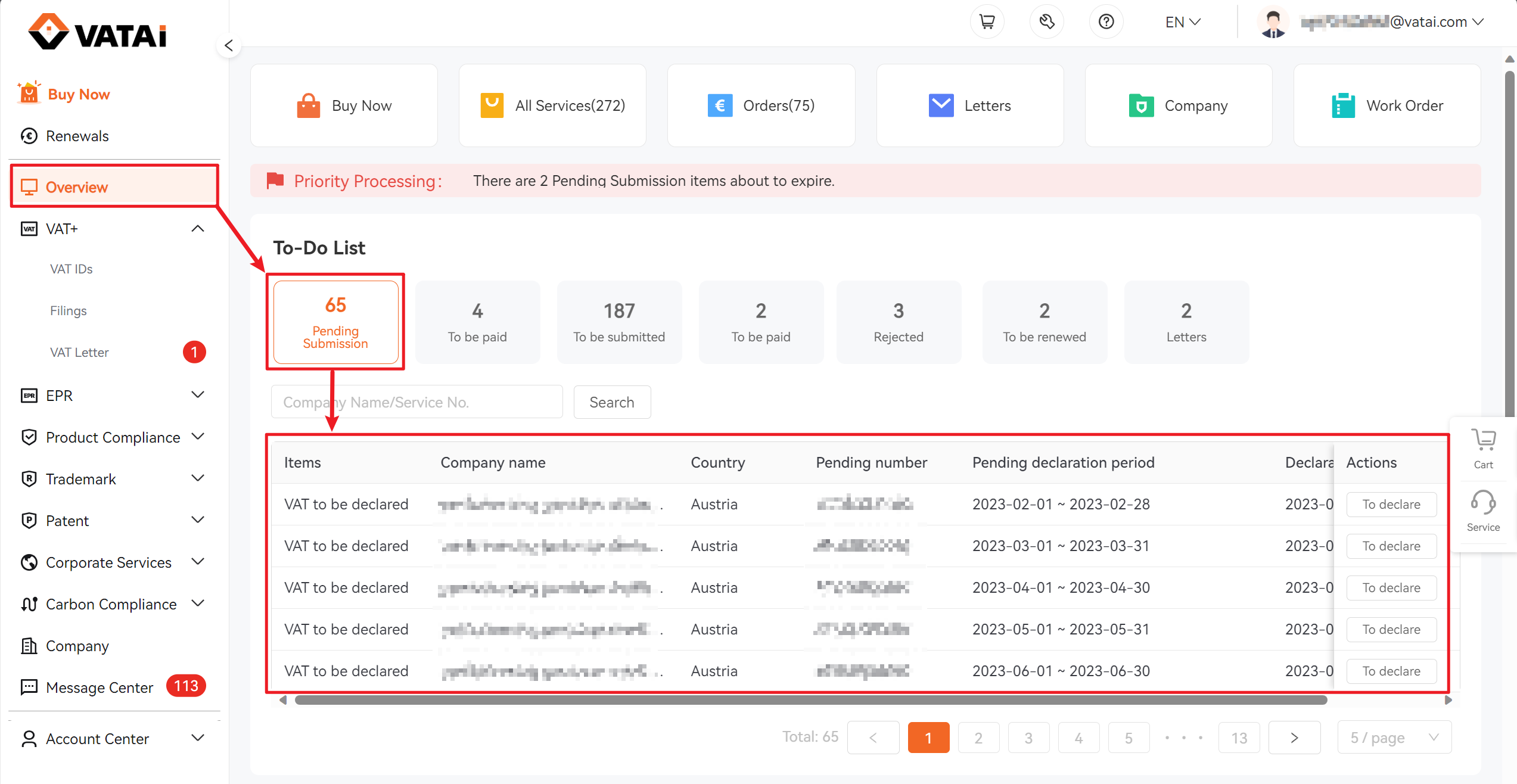

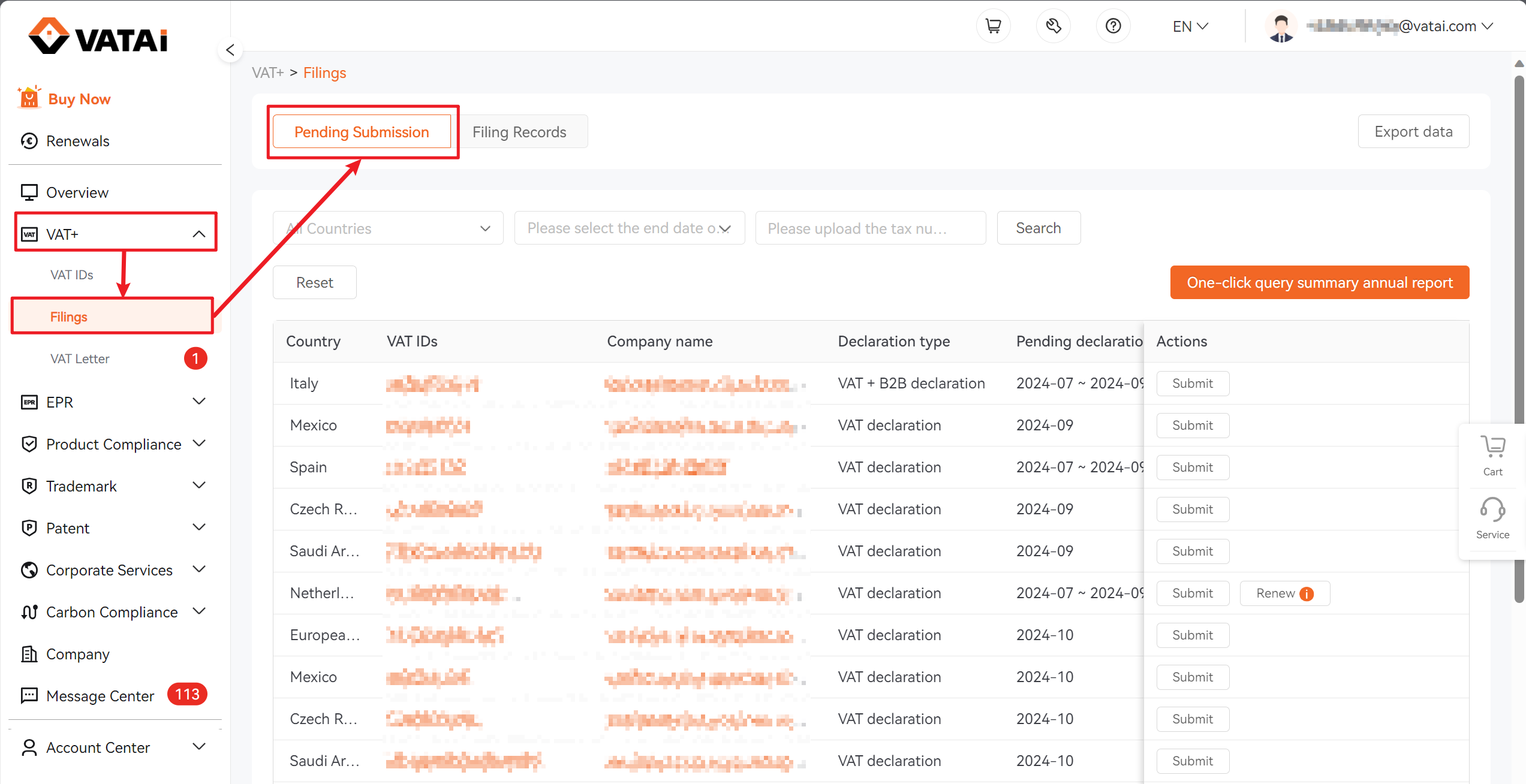

Step1: Access Pending Filings List

There are two ways to view your current pending filings:

Method 1: Navigate to Overview -> To-Do List -> Pending Submission

Method 2:Navigate to VAT+ -> Filings -> Pending Submission

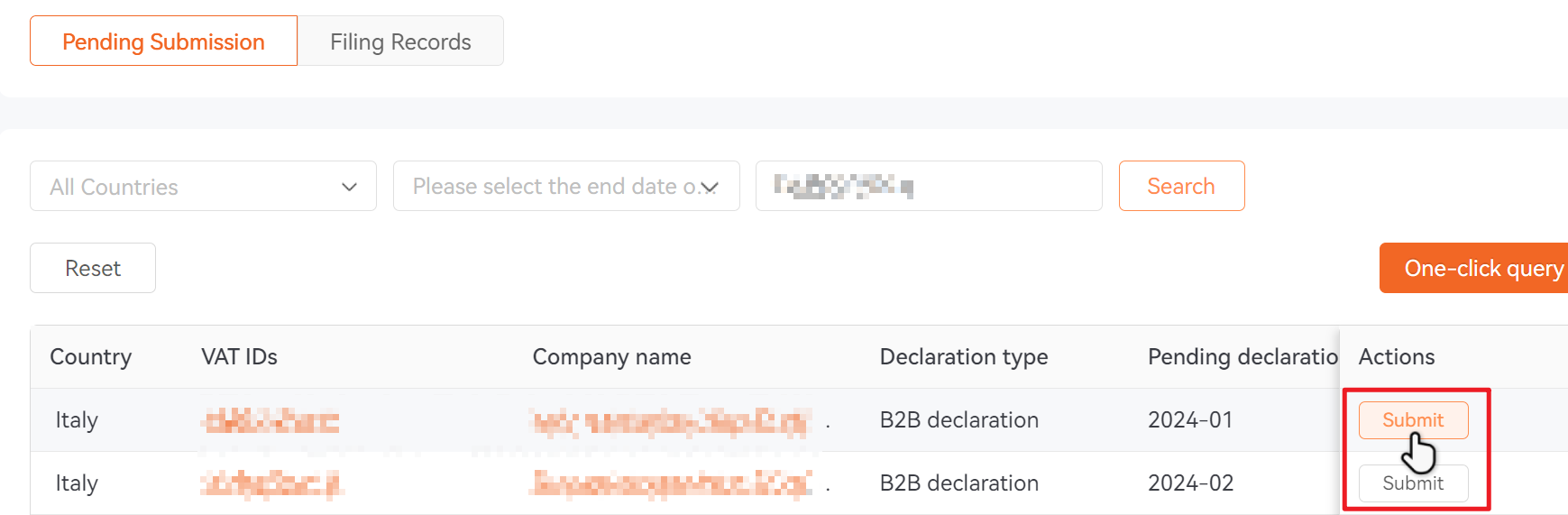

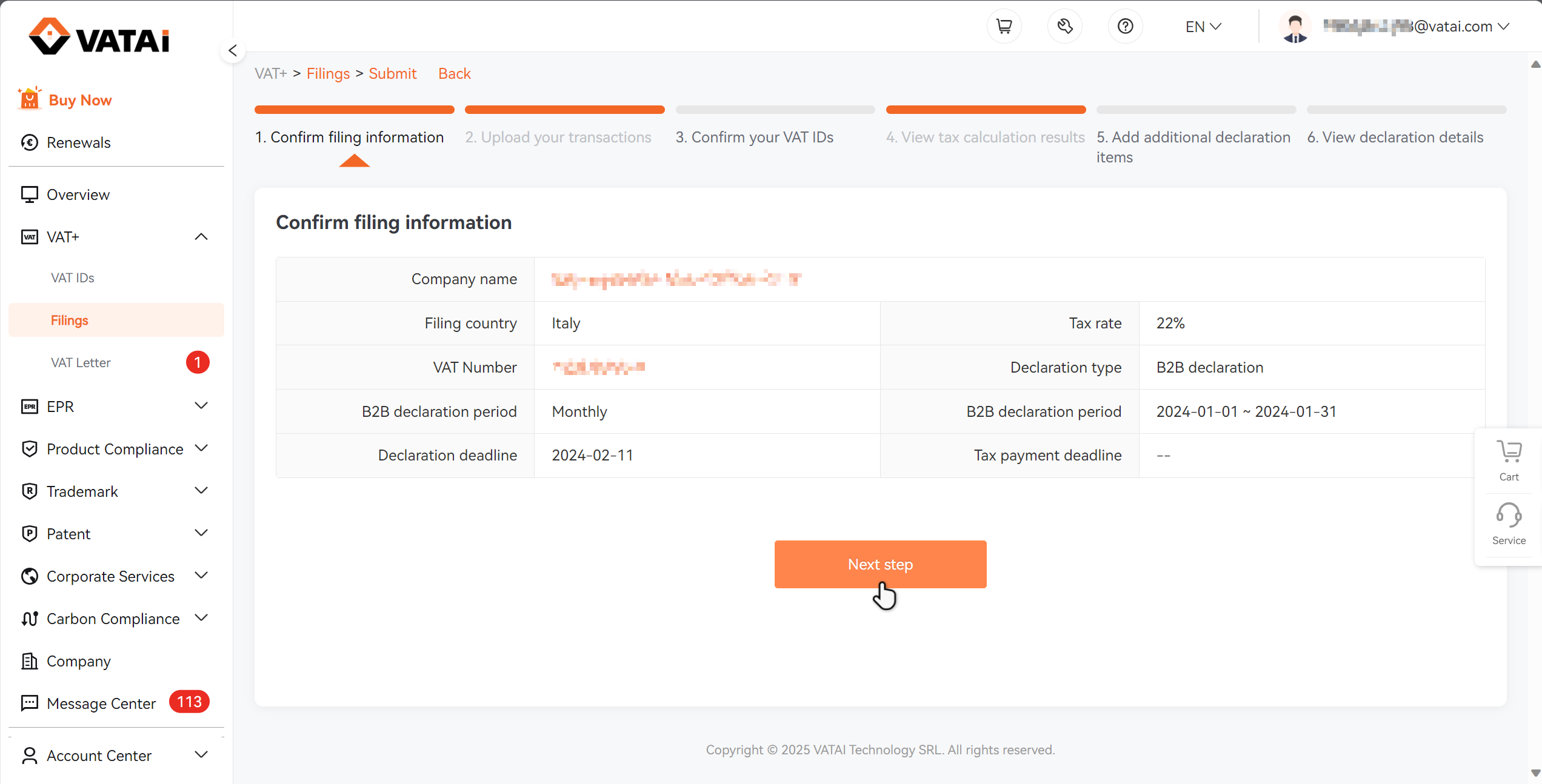

Step2: Submit Filings

2.1 Click the "Submit" button to enter the filings submission page.

2.2 Review and confirm your filing information for accuracy, then click "Next step" to continue.

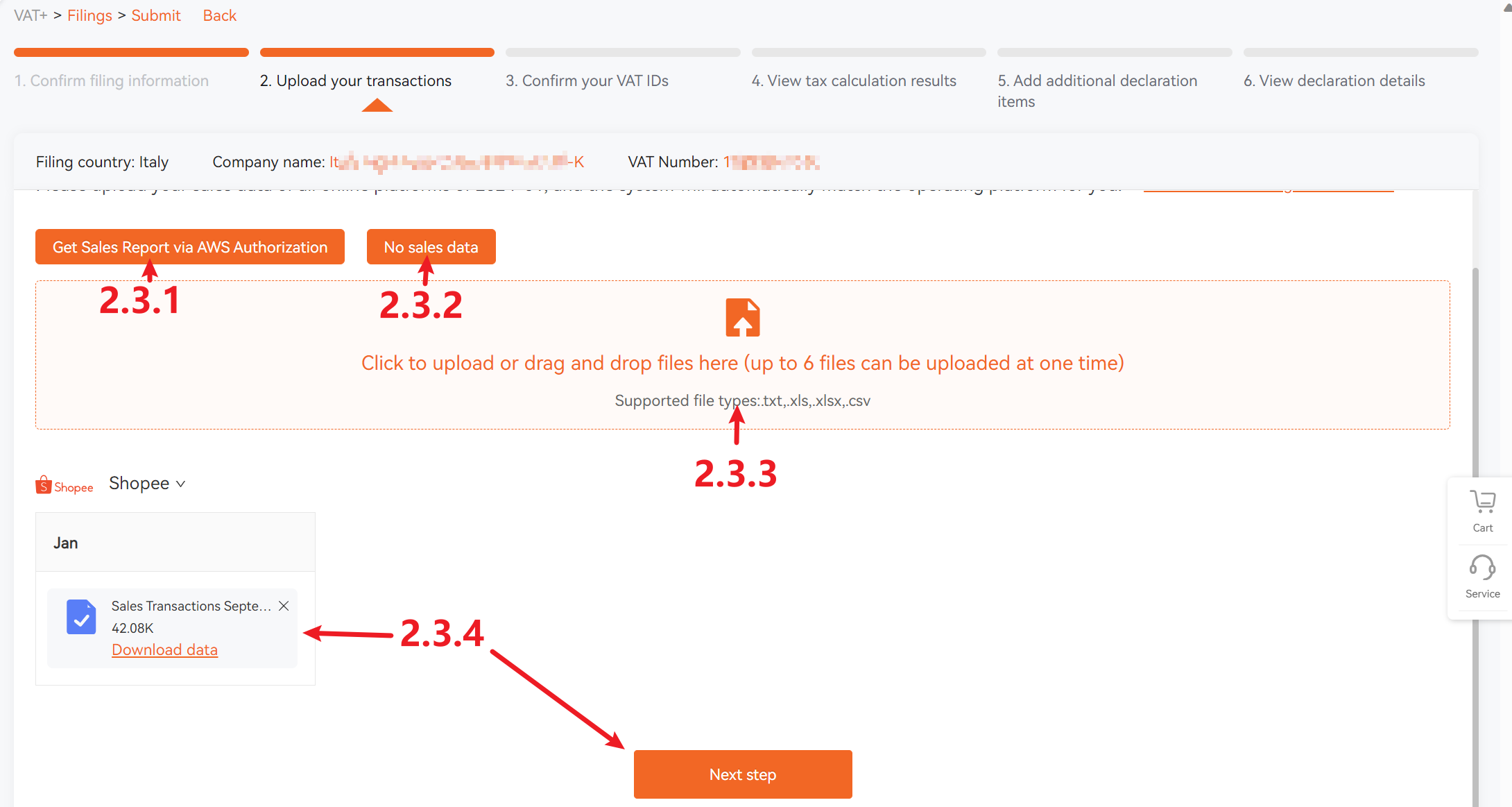

2.3 Upload Your Sales Data

2.3.1 If you sell through Amazon, the system will automatically retrieve your sales report after authorization.

2.3.2 If you have no sales for this period, click the "No sales data" button to submit a nil return.

2.3.3 Upload your sales report by dragging and dropping files or clicking to upload. Automatic tax calculation available for Amazon, eBay, and Aliexpress reports.

2.3.4 Once processed, files will be listed by month below. Click "Next step" to calculate tax.

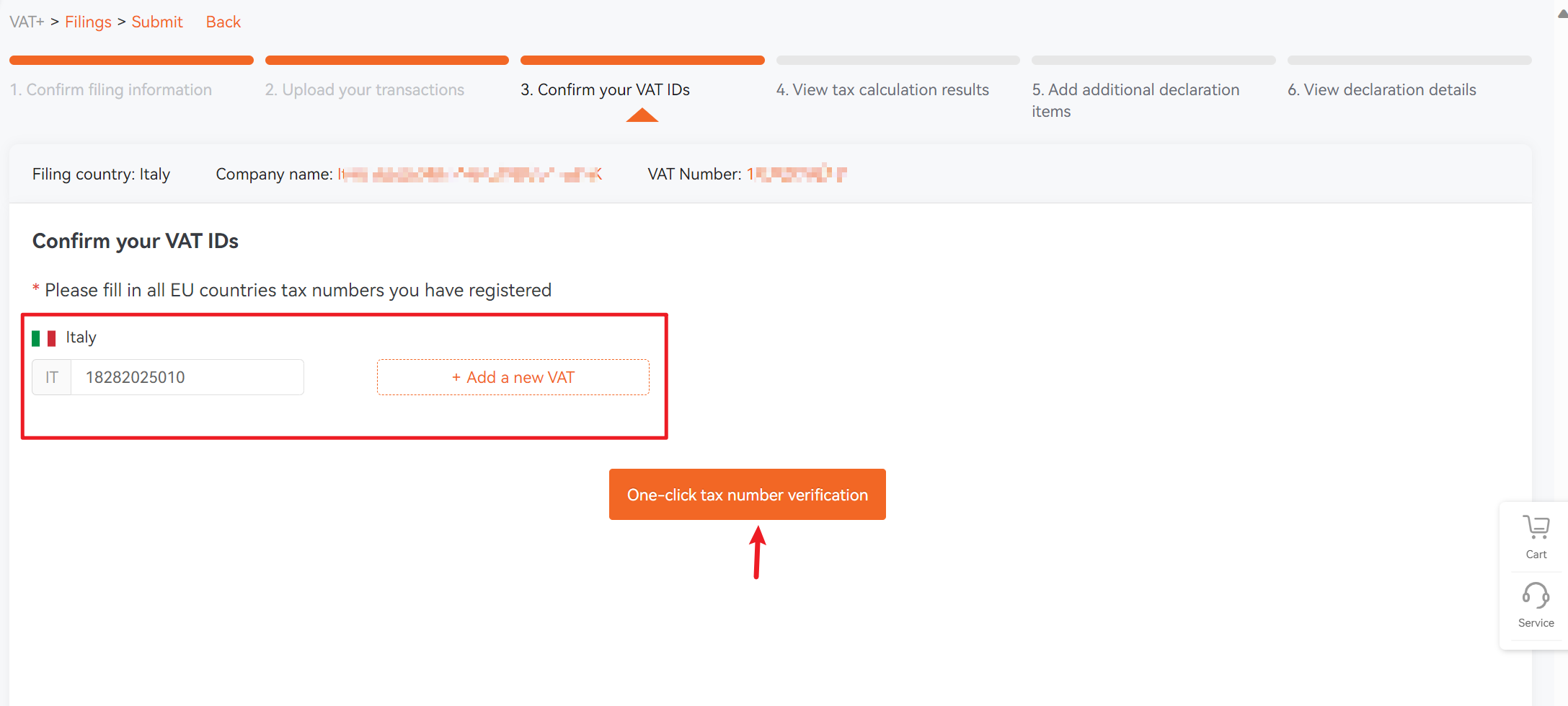

2.4 Confirm your VAT Numbers

The system will display your registered VAT numbers. If you need to add additional VAT numbers, click "Add a new VAT". After adding all numbers, click "One-click tax number verification" and then "Start calculating taxes" to proceed.

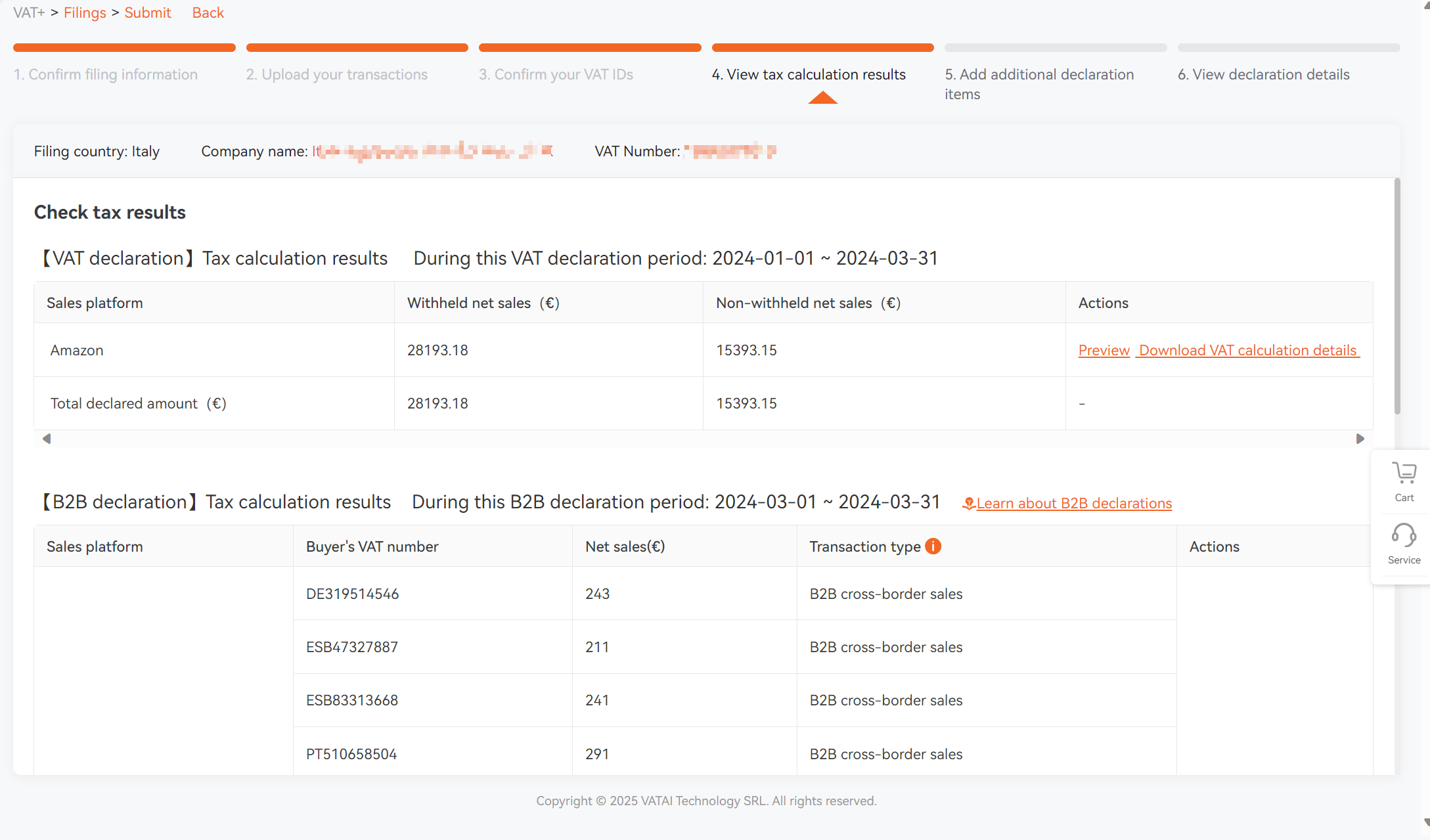

2.5 Confirm Tax Calculation Results

Review the calculation results by platform. Once verified, click "Next step" to continue.

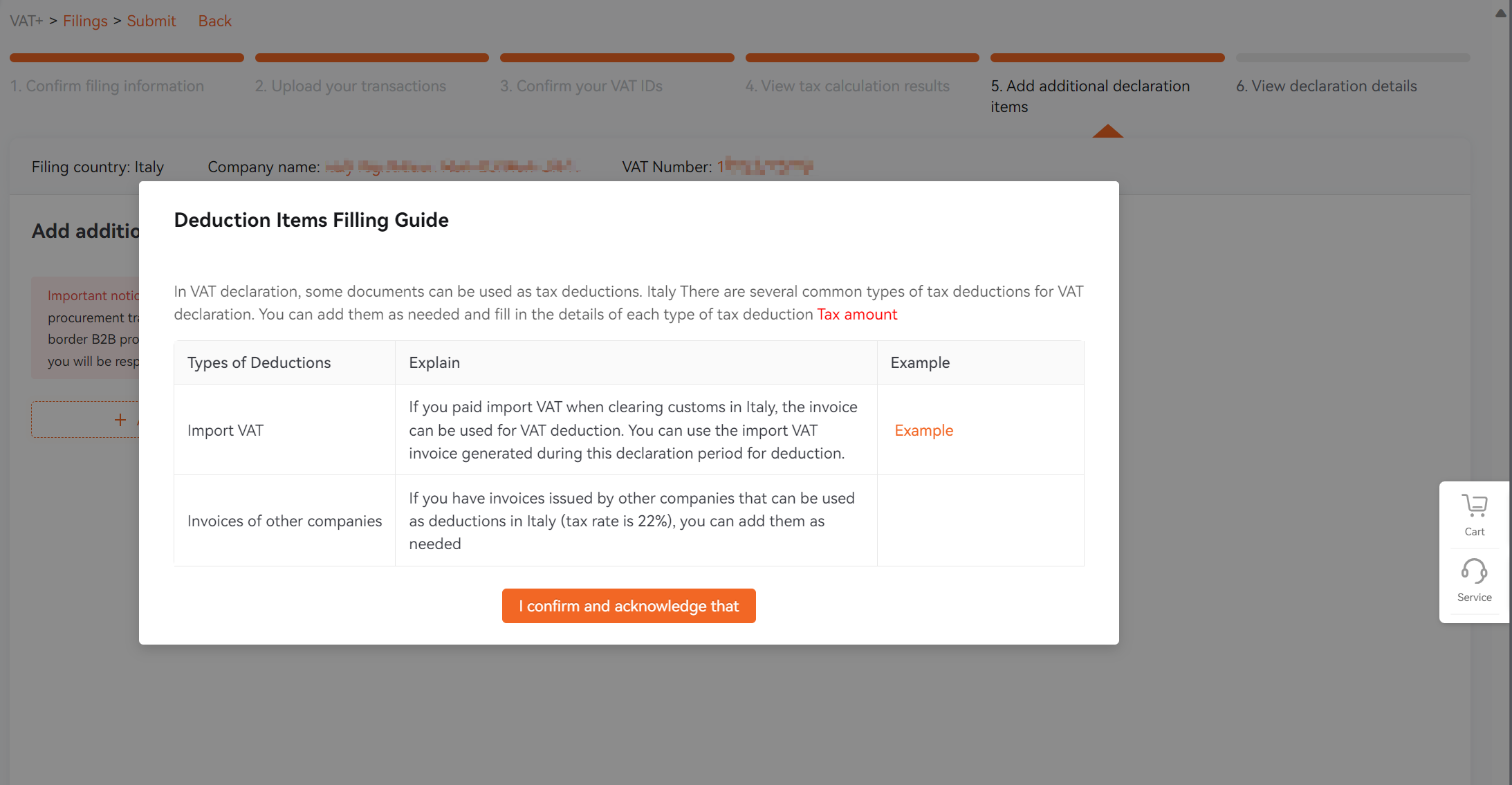

2.6 Add Additional Filing Items

You may add other filing items such as Import VAT or Invoices of other companies on this page.

Available deduction items vary by country - please refer to the on-screen guide for details.

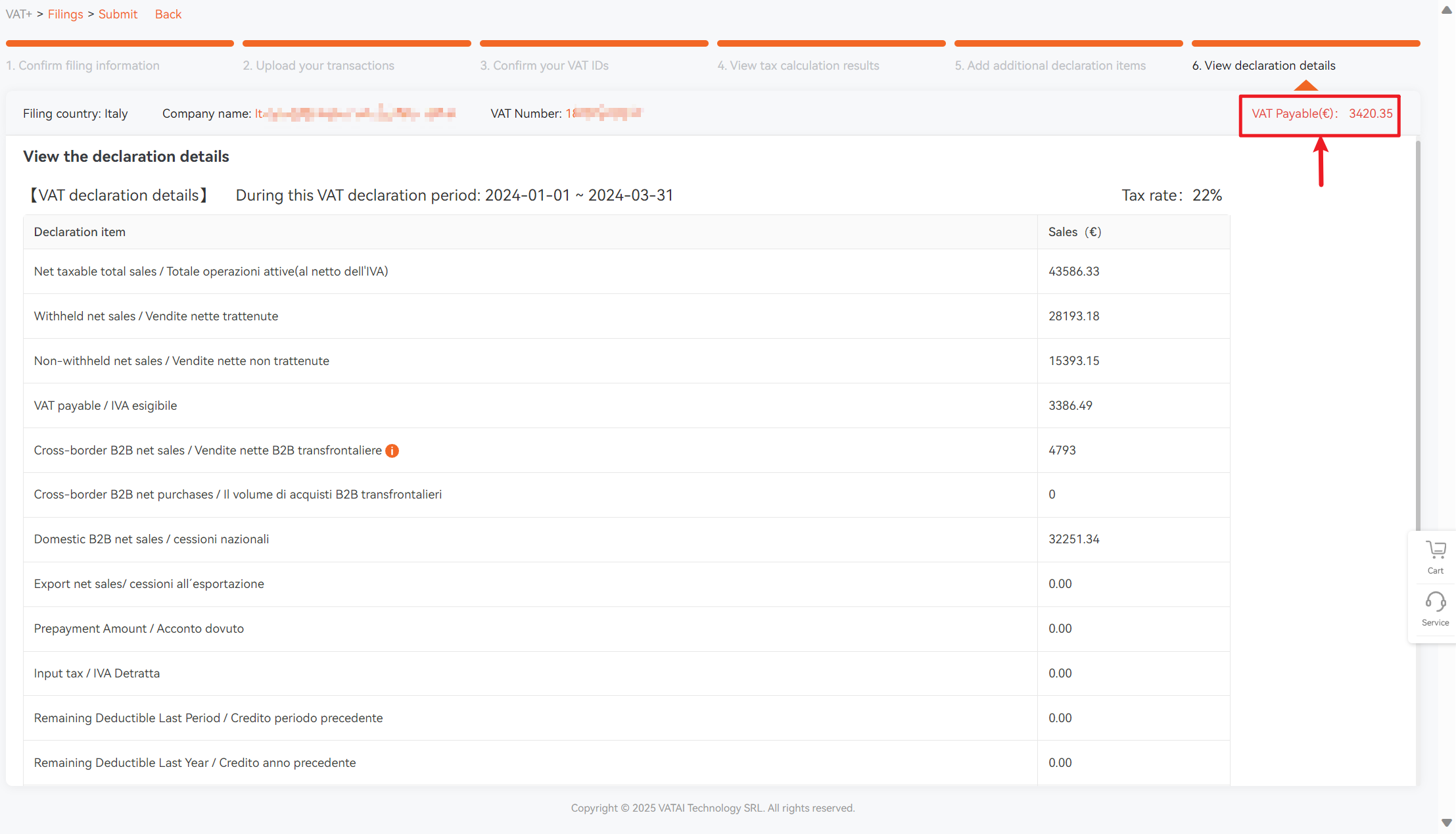

2.7 View the Declaration Details

This page shows your final declaration details, including taxable sales, tax amounts, deductions, etc.

To review tax information, click "Review the tax confirmation letter".

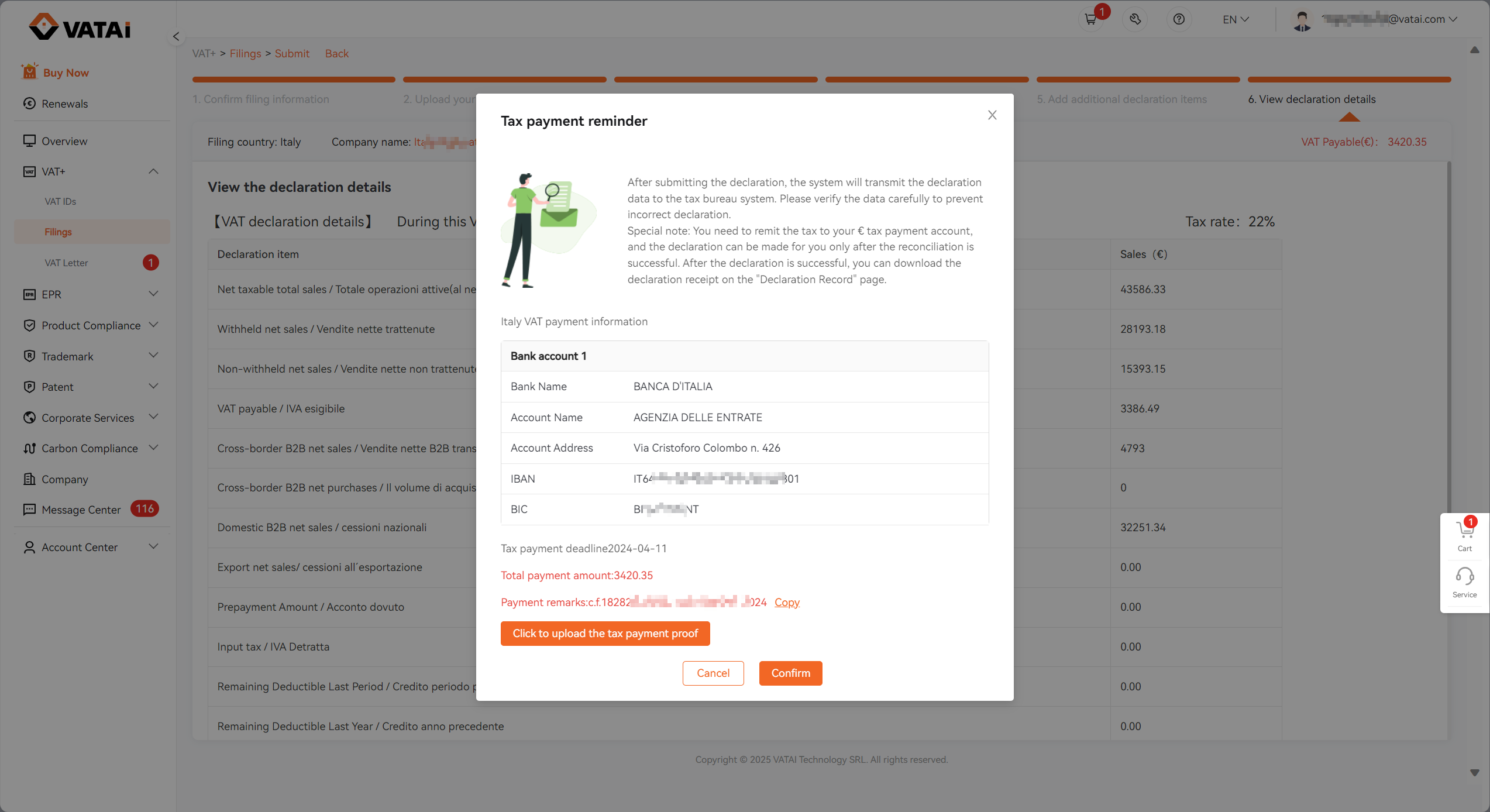

You can either review the details in the popup window and click "Submit" to proceed to payment.

After payment, upload your proof of payment and click "Confirm" to complete the declaration. Once processed, your data will be transmitted to the tax authorities and you can download your declaration receipt from the system.

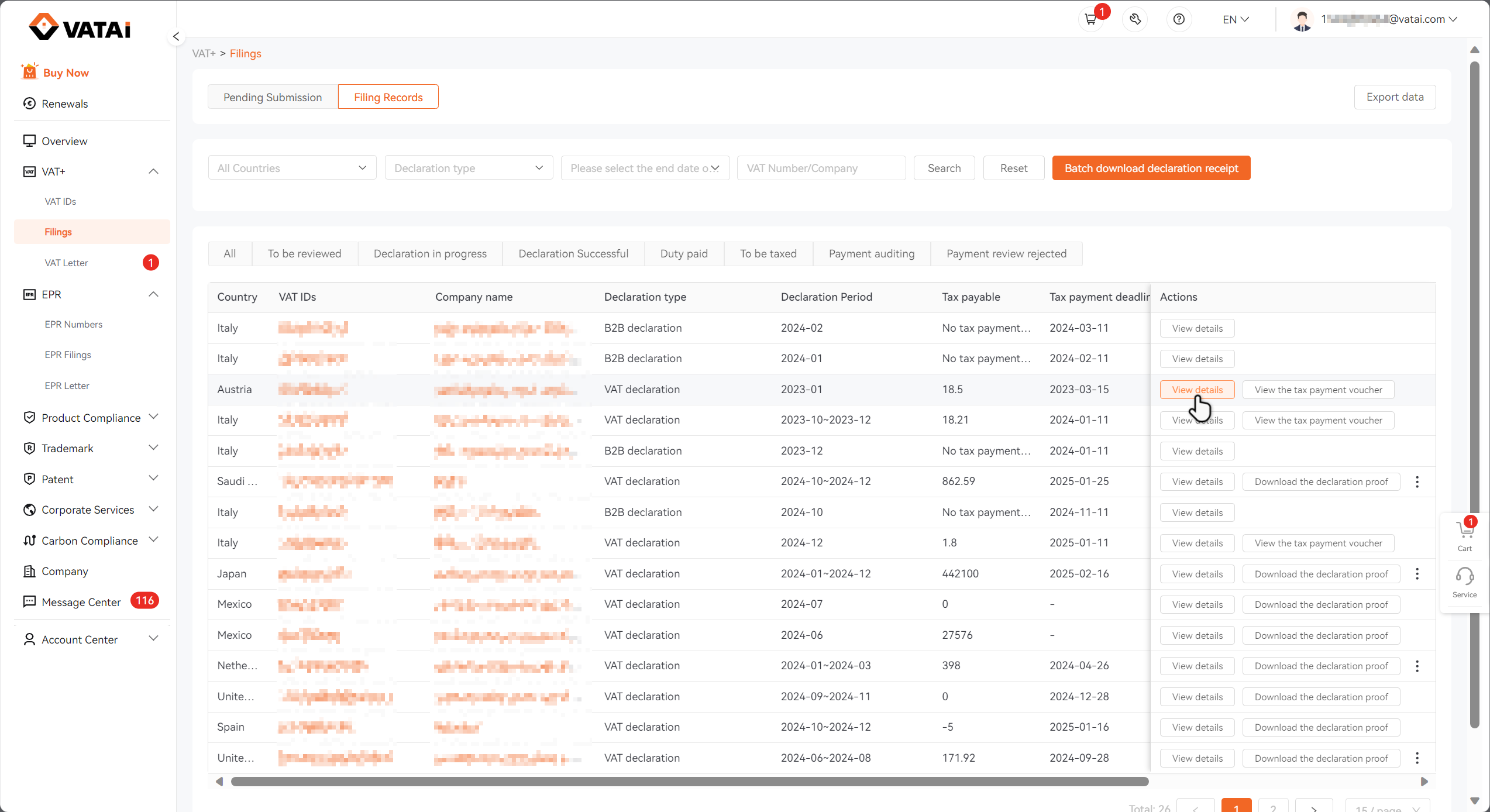

Step3: View the Filings Records

Negative to VAT+ -> Filings -> Filing Records

You can view all the filing records, download tax payment voucher and declaration receipts on this page.

Need Help?

Book a free call with VATAi today to find tailored compliance solutions for your e-commerce business.