Step1: Log in to the Merchant Portal

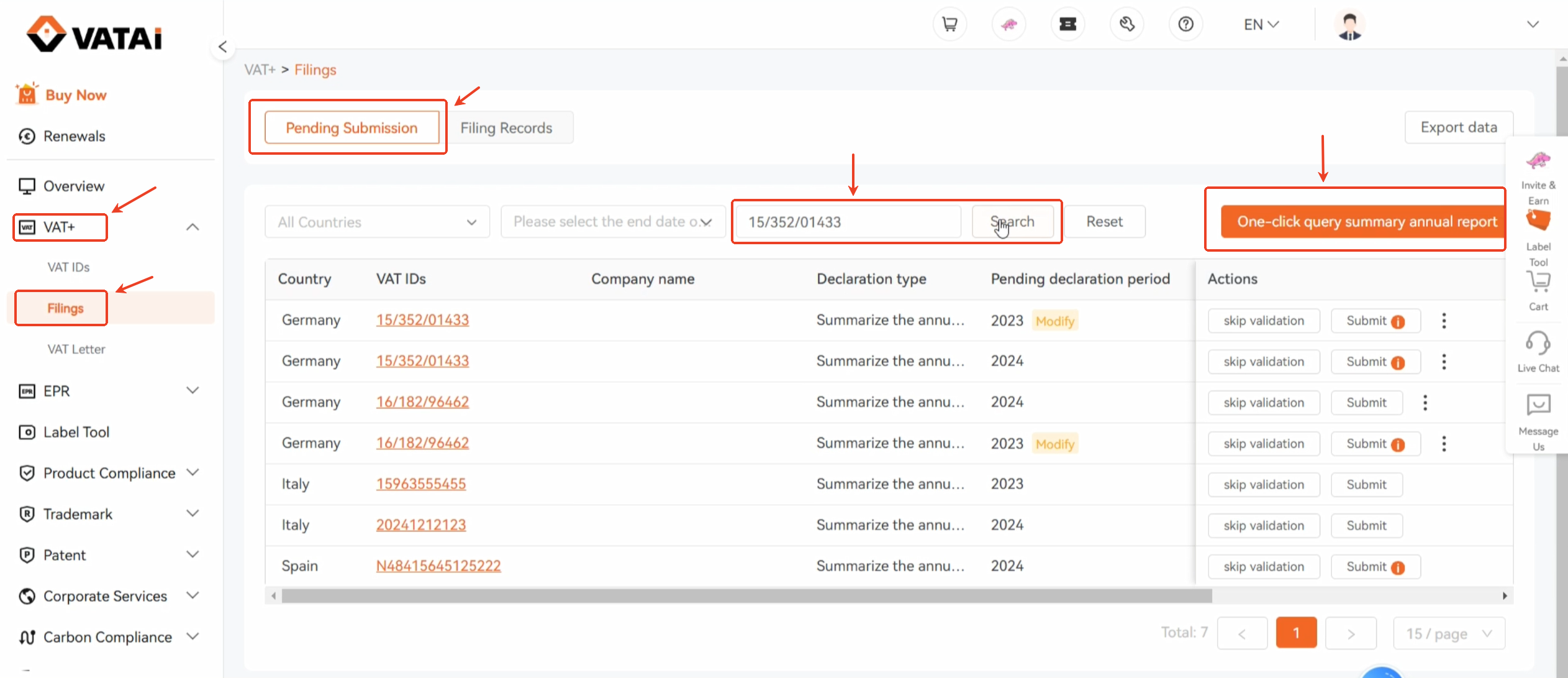

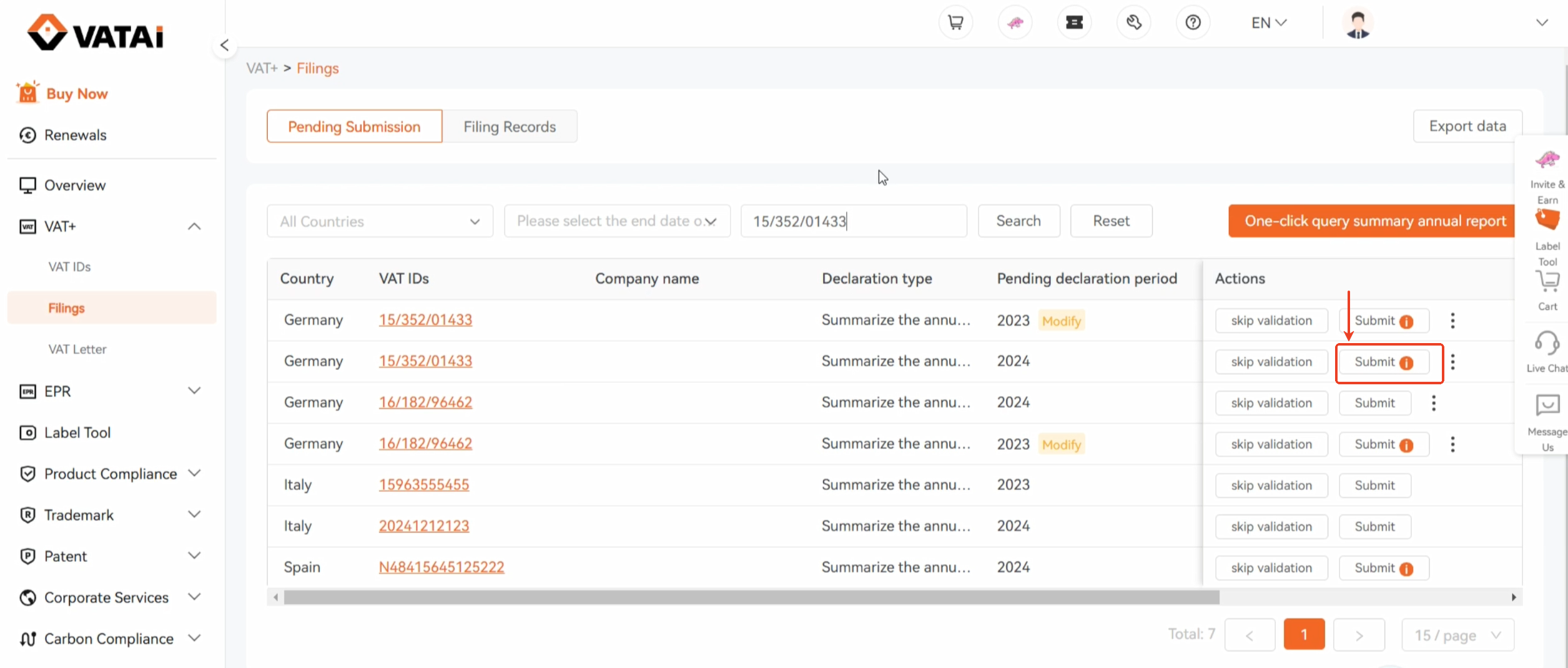

Step2: Access the VAT Annual Report Query Portal and Query

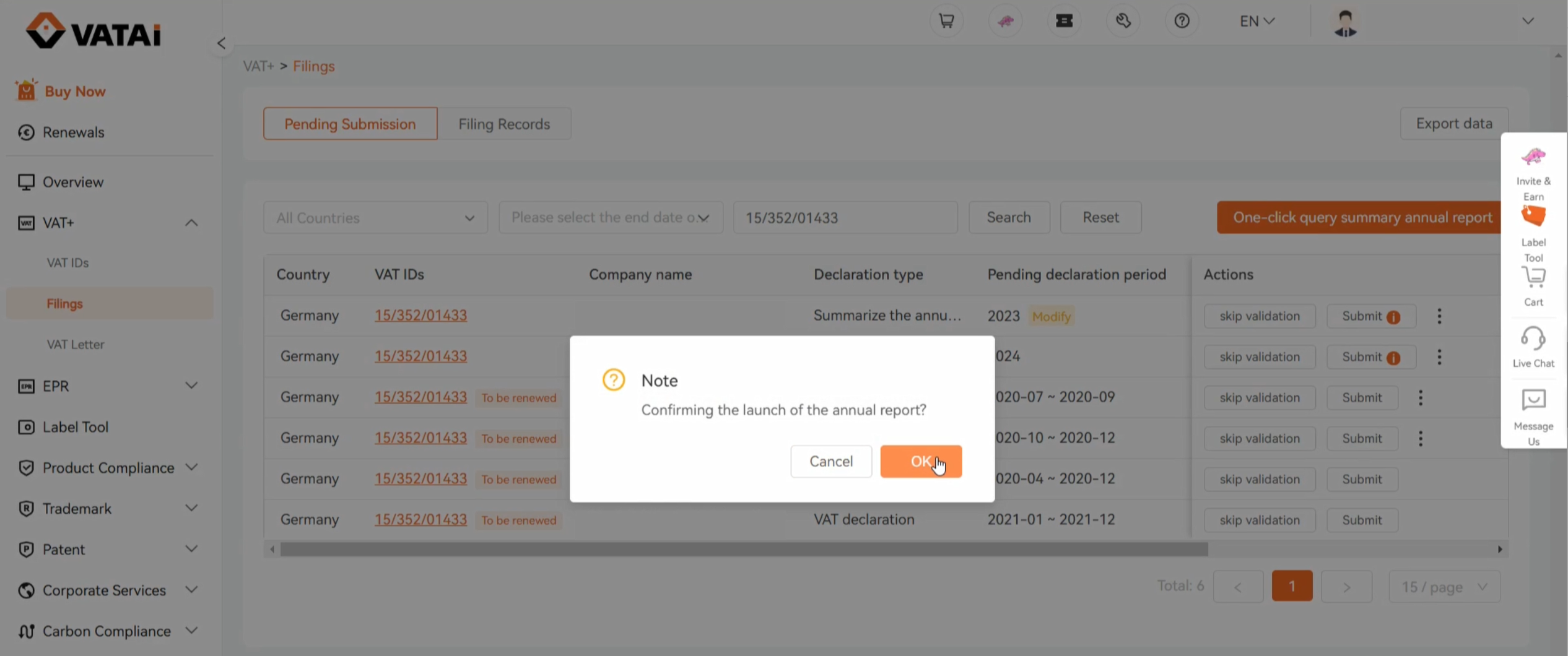

Click VAT+ button on the left-hand side of the page, then click Filings button to enter the pending submission page.

Click One-Click Query Summary Annual Report tab and enter the company name or VAT number you wish to report.

Next, click Submit in the corresponding action column.

Please note: If you still have pending monthly or quarterly filings for 2024 in the Merchant Portal, you must successfully submit all preliminary declarations for the year before initiating the annual filing for 2024.

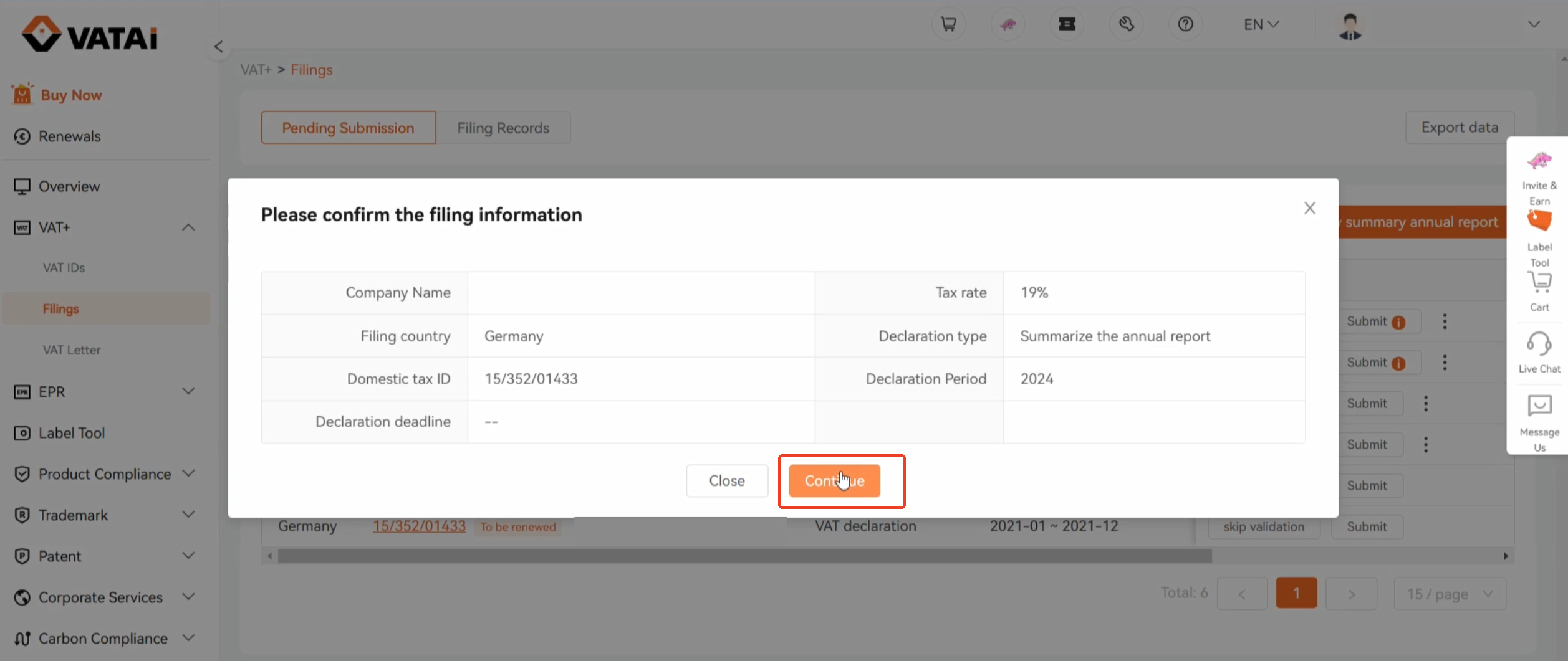

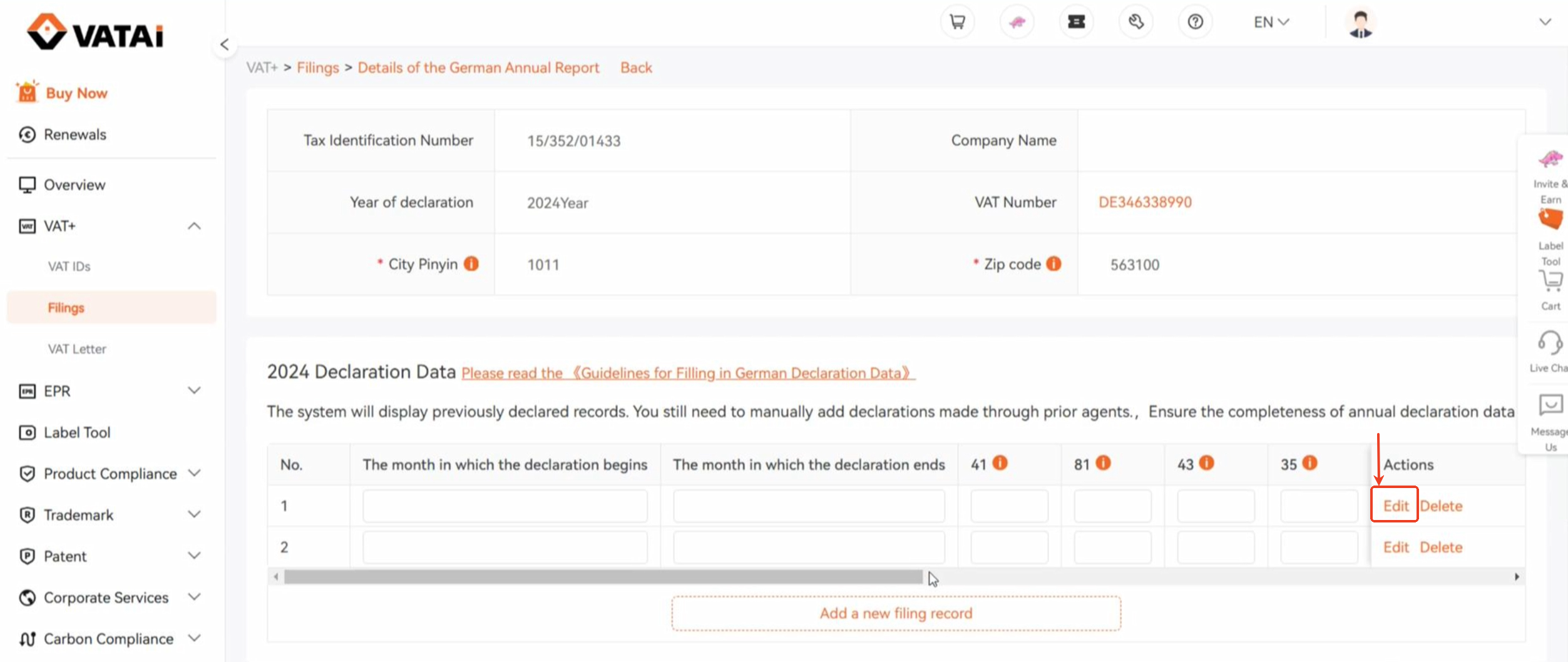

Step3: Entering the Germany Annual Report Details

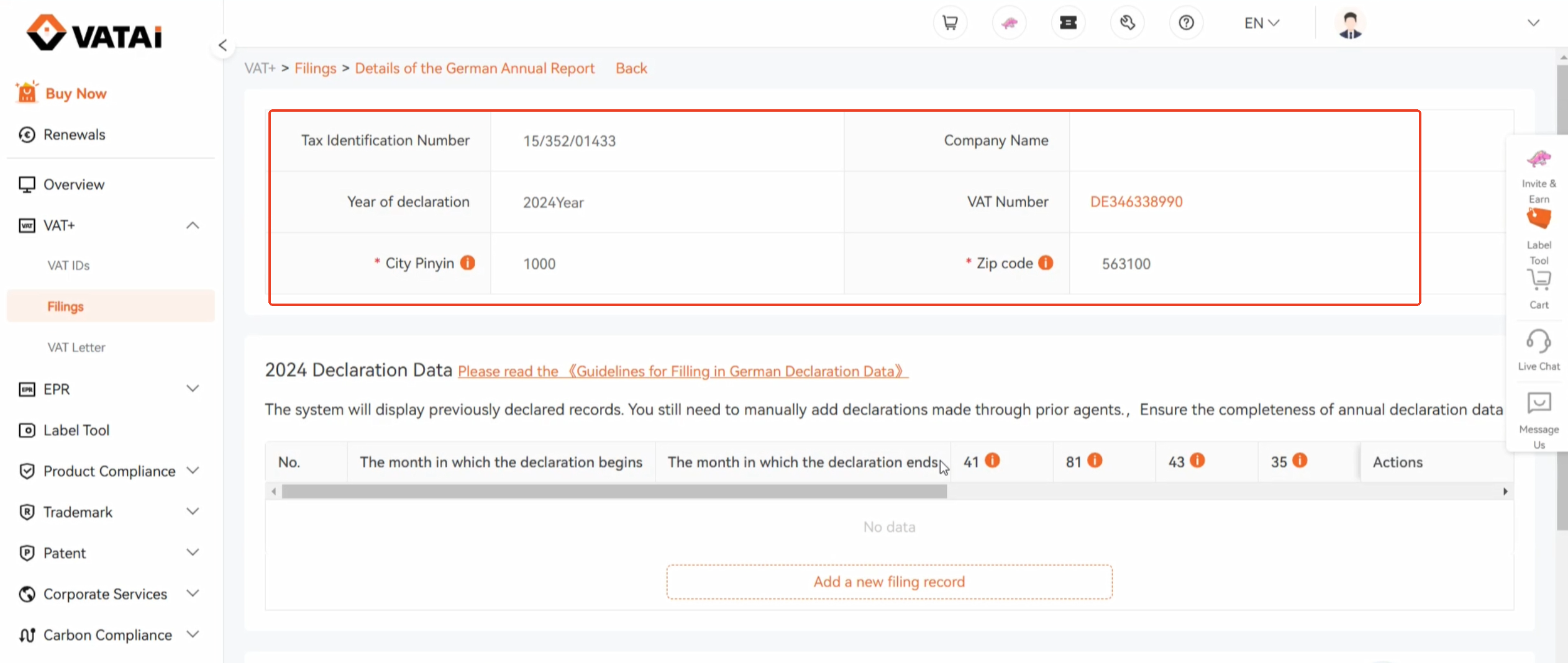

After clicking Confirm, you will enter the Germany annual report details page.

Please verify your company’s address, zip code, company name, VAT number, and the declaration year are correct. If the Address needs to be modified, simply click to edit it.

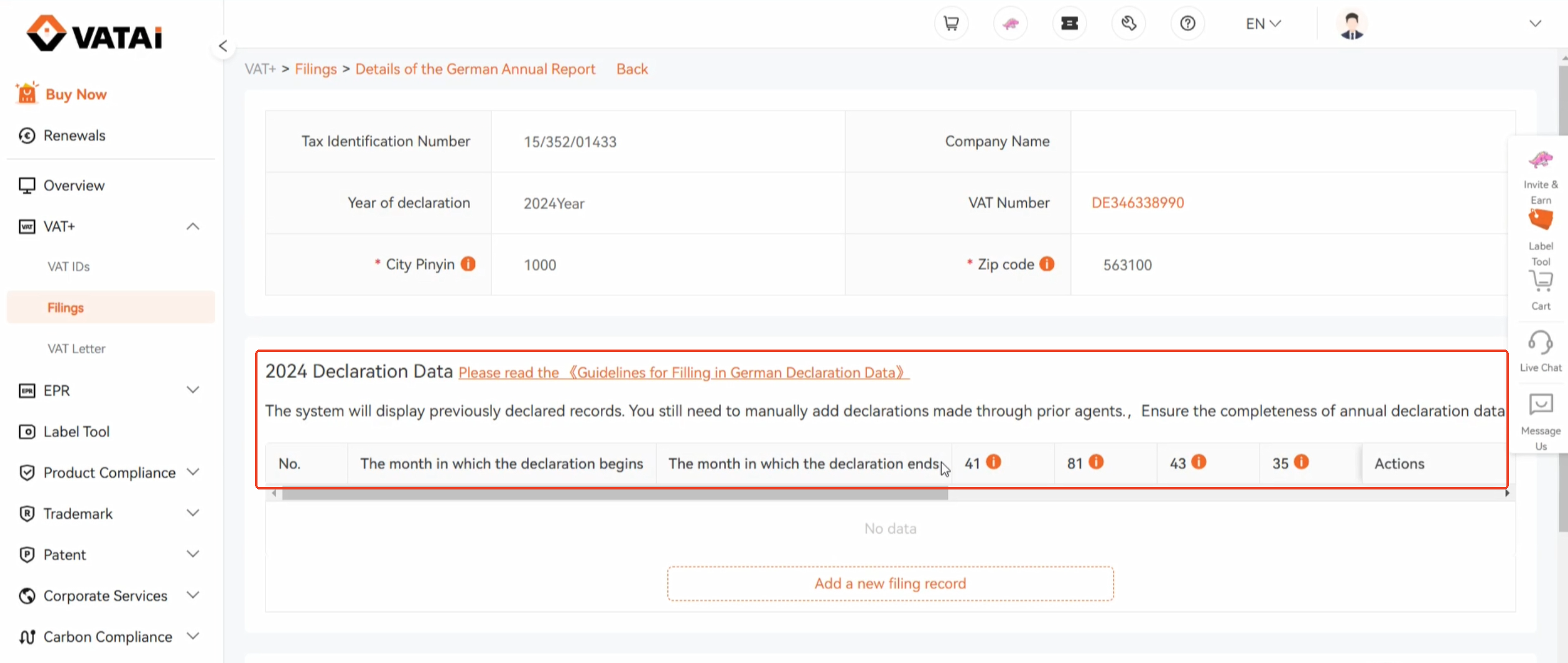

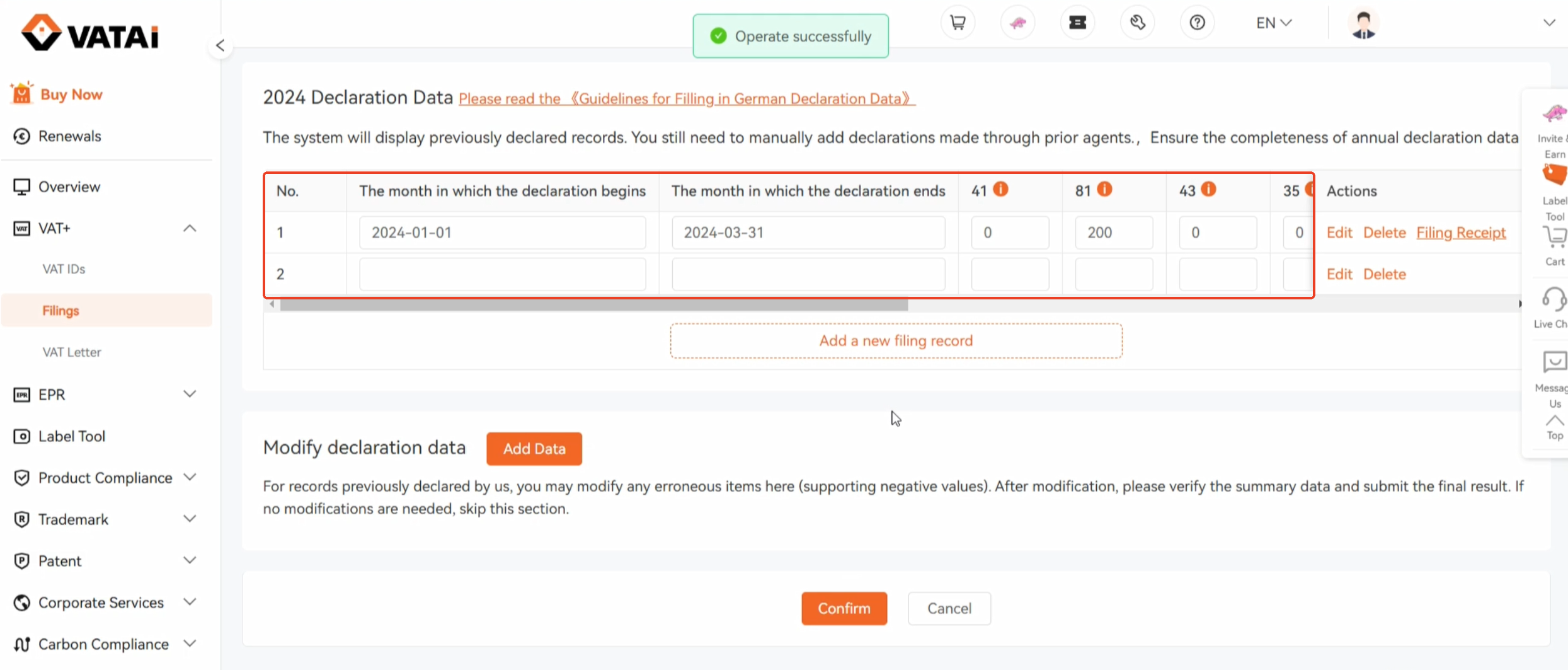

The preliminary declaration data for 2024 will be displayed below.

If your preliminary declaration data has already been submitted through the system, it will appear here.

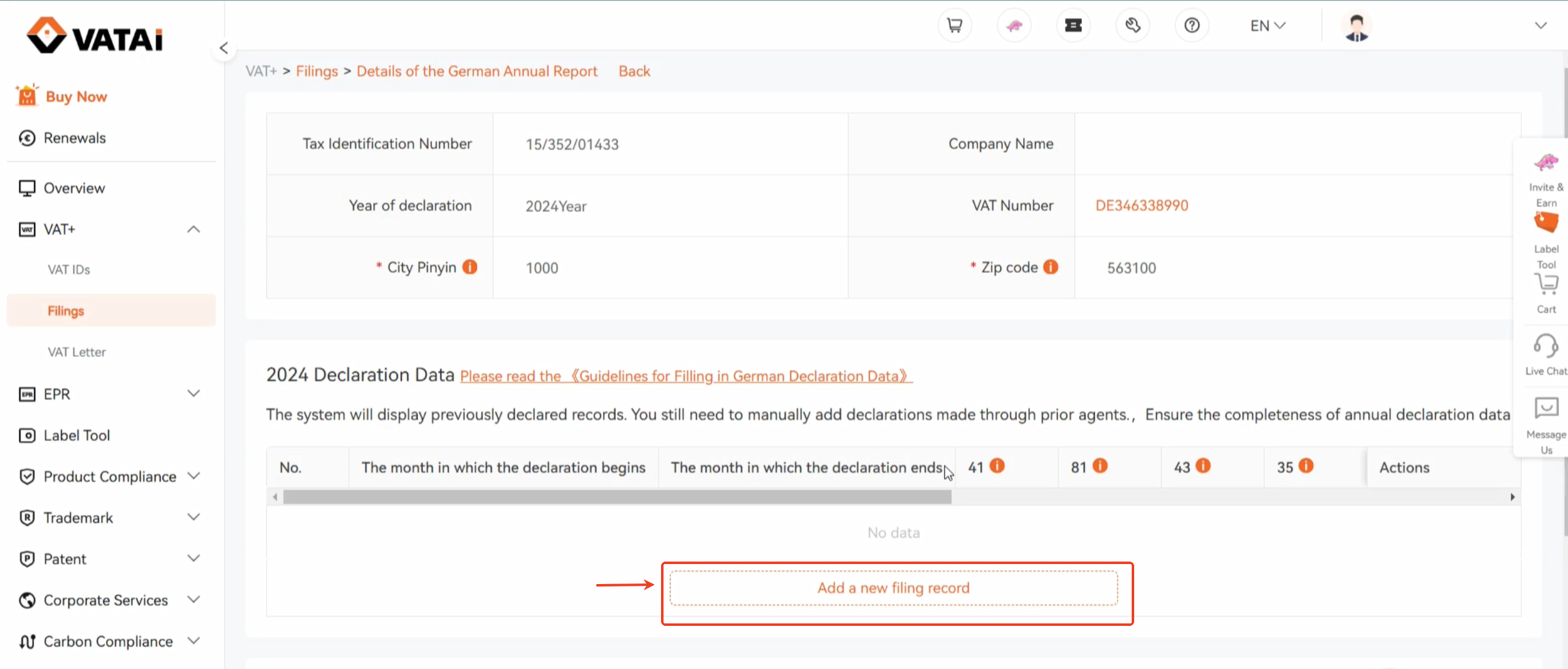

If you have not submitted the entire year’s preliminary declarations through the system, you can click Add a New Filing Record. If you submitted all of your 2024 preliminary declarations through your previous agent, for monthly declarations, click to add 12 entries; for quarterly declarations, add 4 entries.

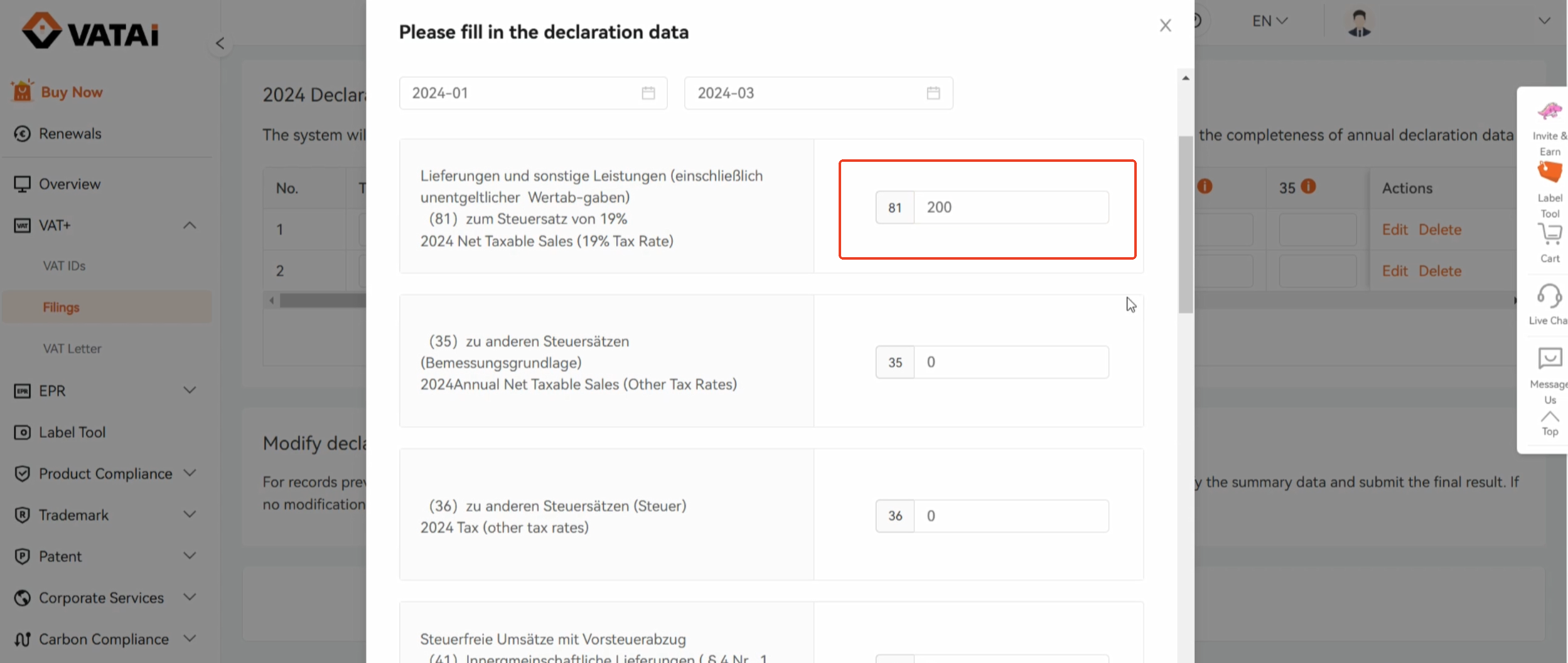

Step4: Editing Declaration Records

Click Edit and choose whether it is a zero declaration, as well as the starting and ending months for the declaration.

For monthly declarations, both the starting and ending months should be the current month.

For quarterly declarations, select the starting and ending months for each quarter.

Enter the declaration data according to the declaration proof from your previous agent.

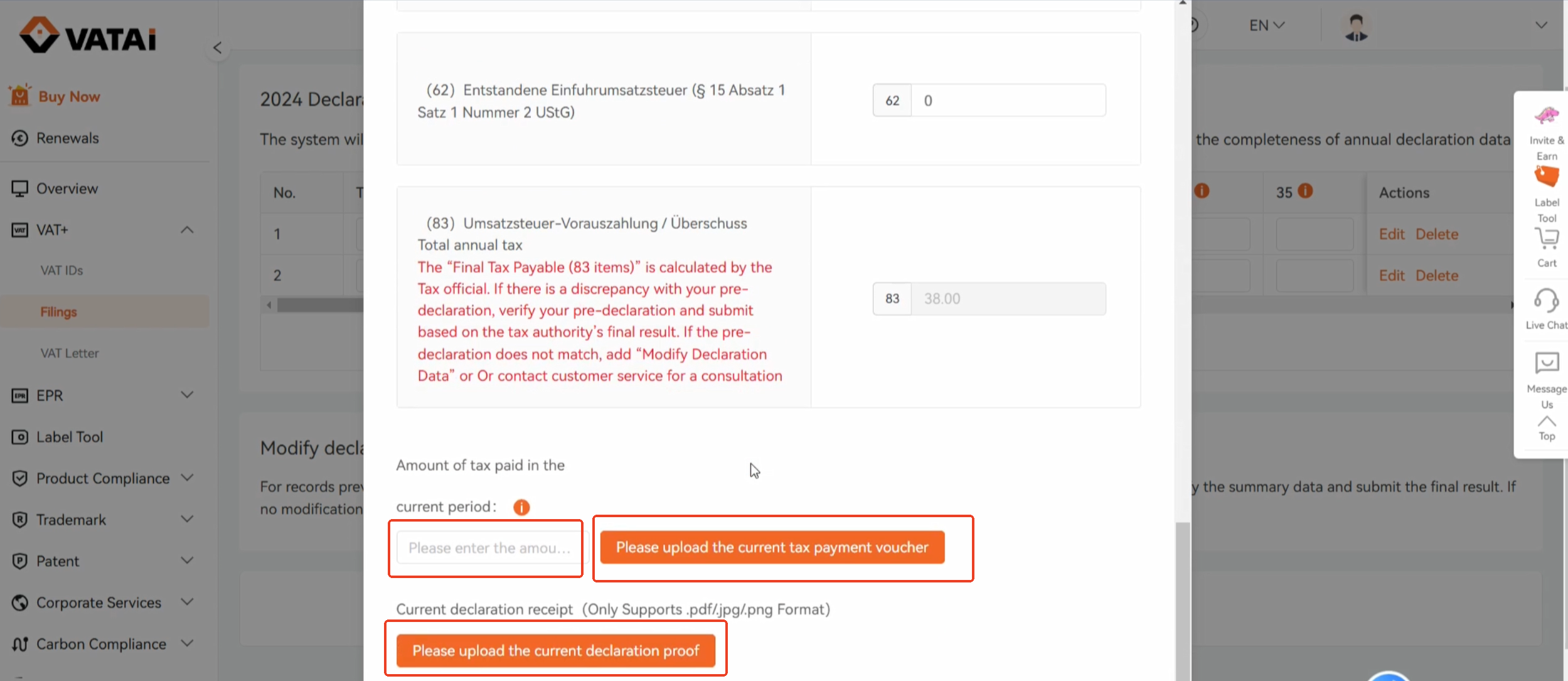

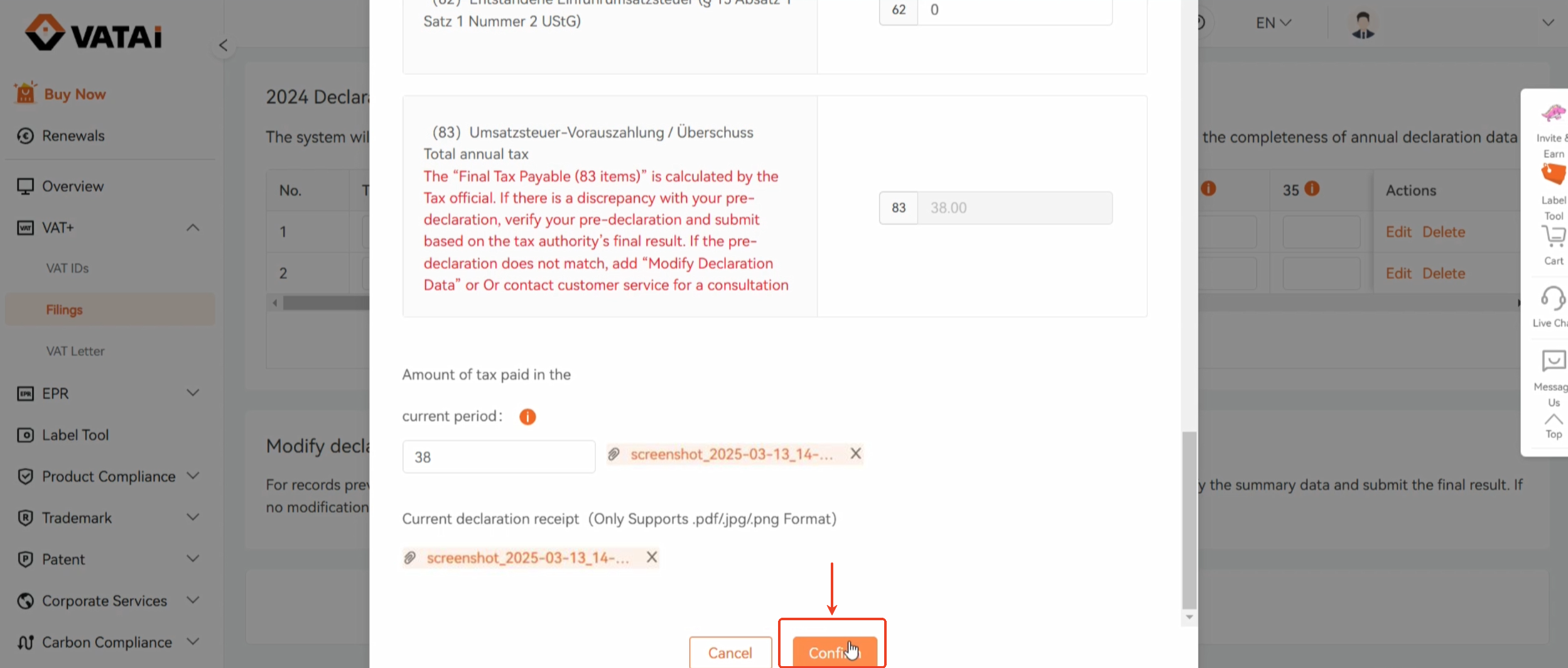

Fill in the tax amount already paid for this period, upload the tax payment voucher and the declaration proof, and verify that all entered data is correct.

Then click Confirm.

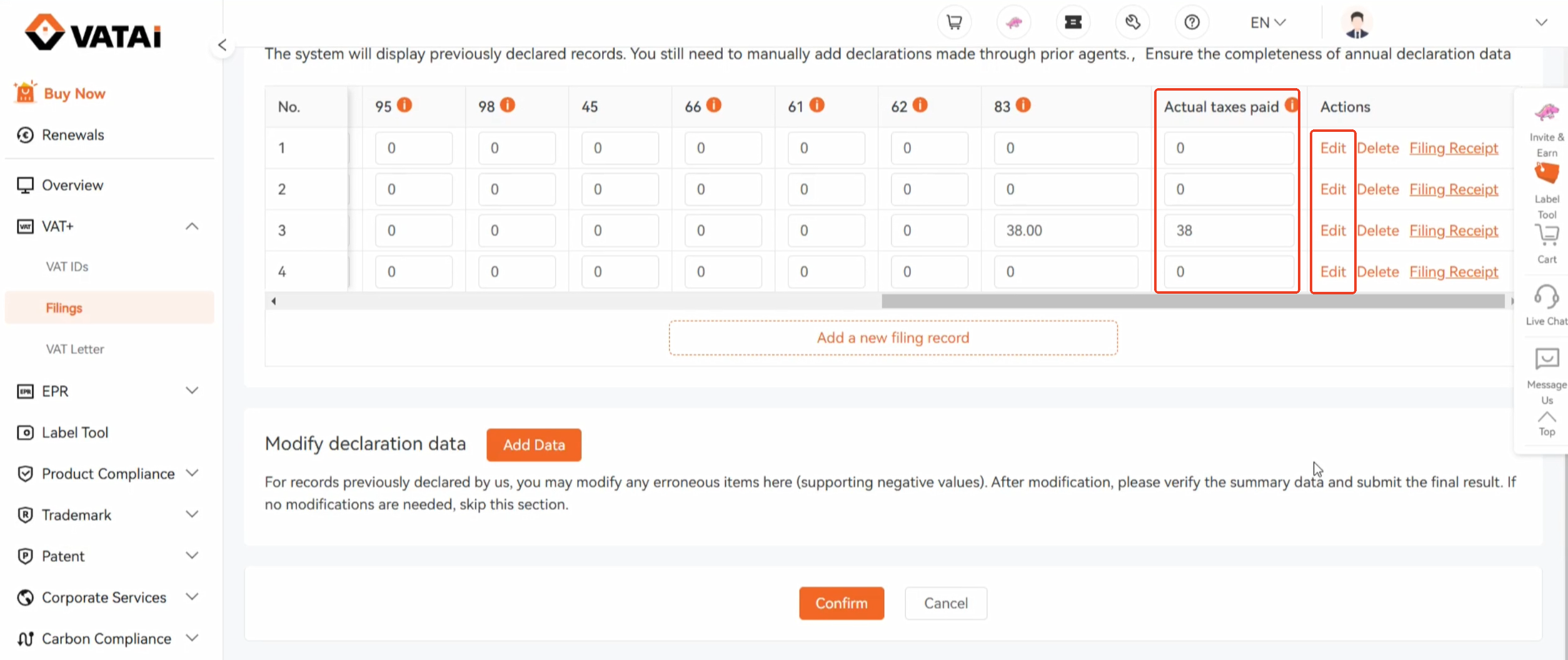

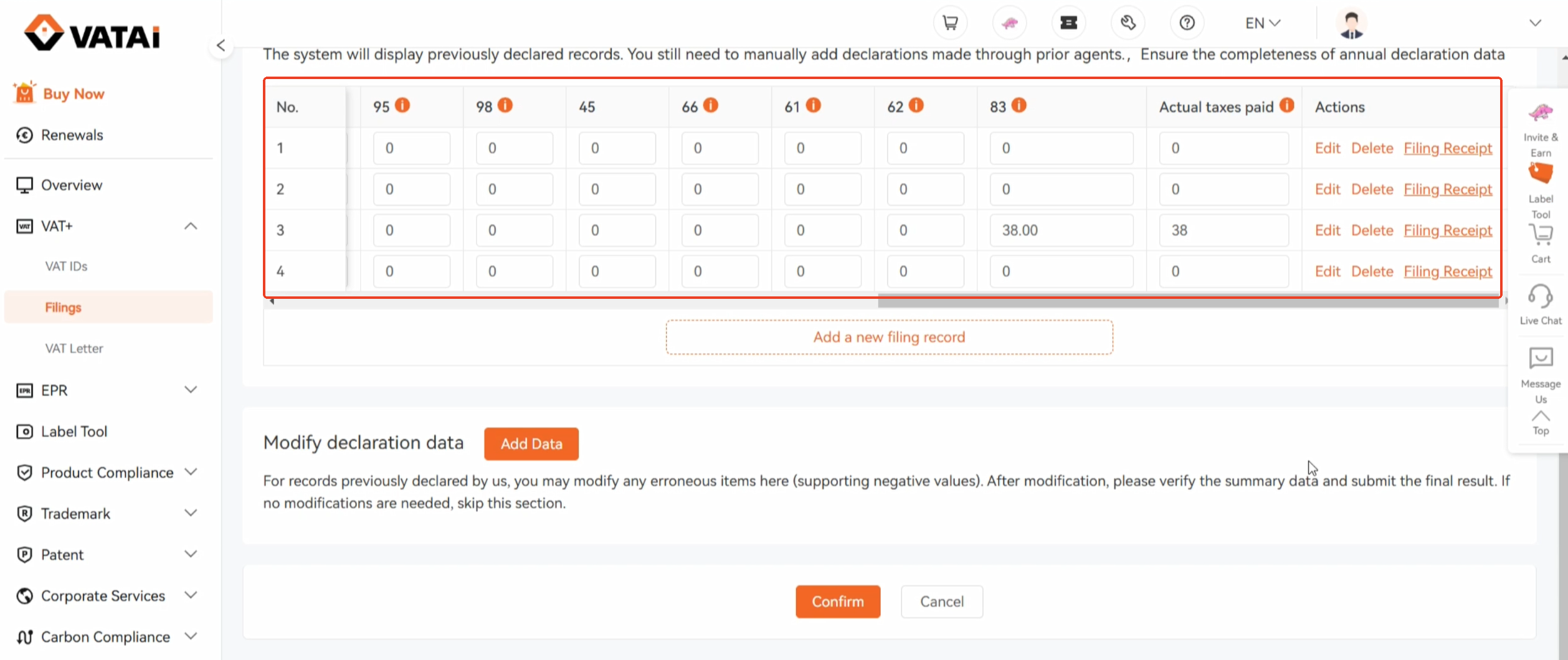

For the preliminary declaration data already in the system, you also need to verify each data field.

Once the data is correctly generated, click on the blank box in the “Actual Tax Paid” column to enter the actual tax paid.

Alternatively, you can click the Edit button, scroll to the bottom of the popup, enter the tax paid for that declaration period, and upload the corresponding tax payment voucher. If the amount is zero, uploading is not required.

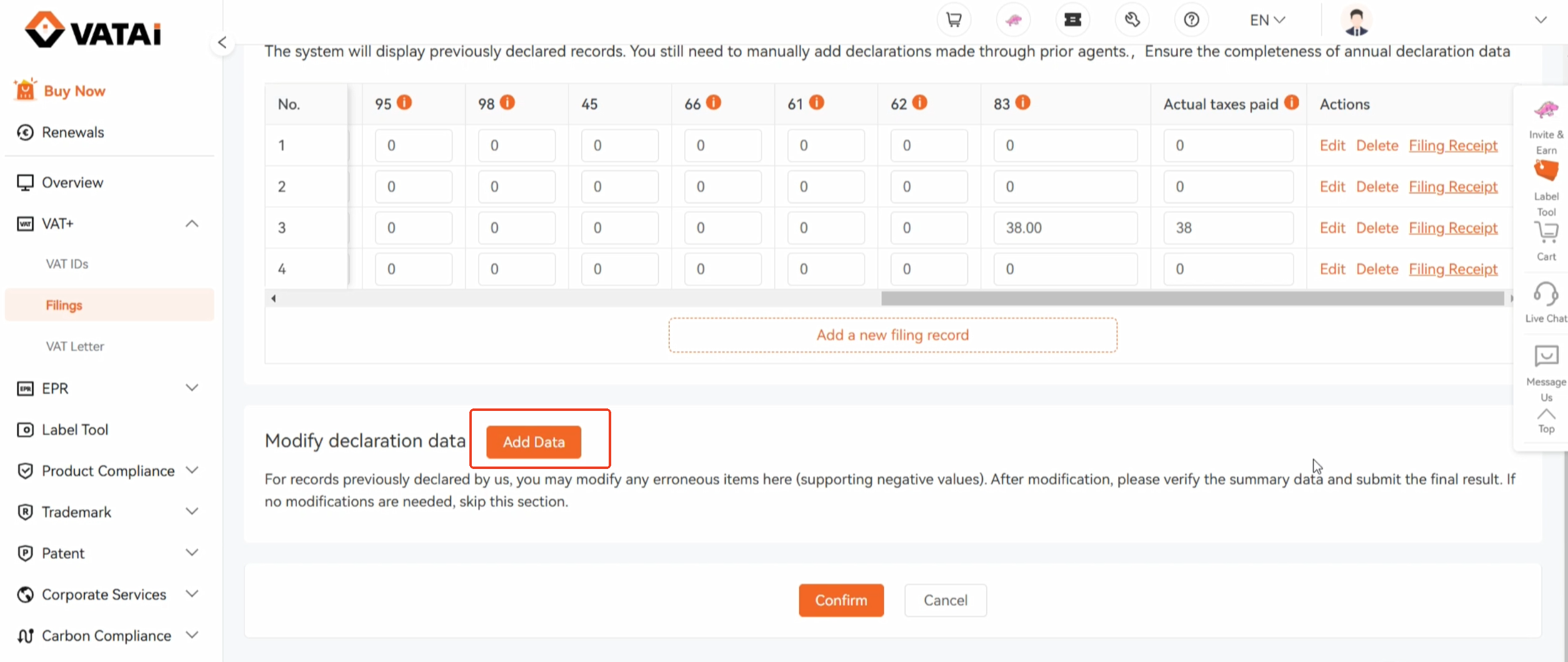

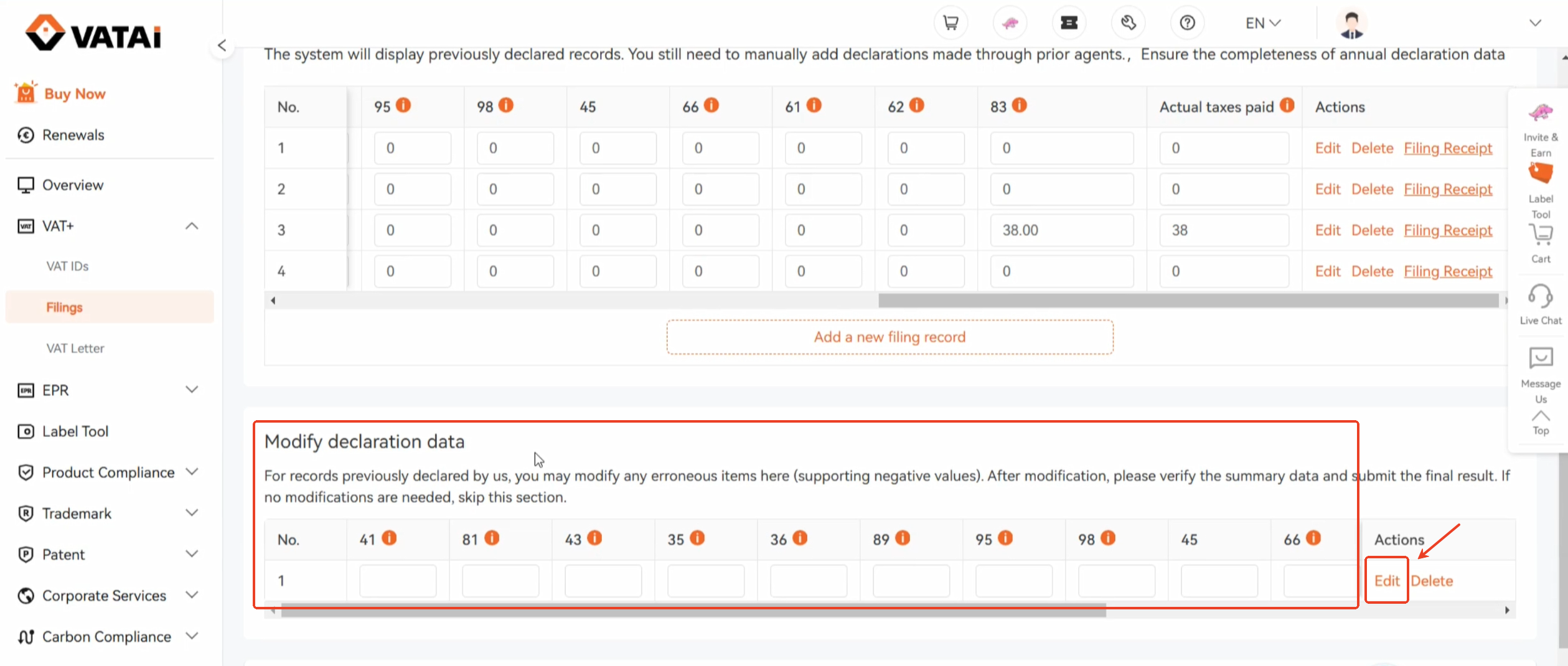

Step5: Modifying Declaration Data

Please Note: For users transferring their agency, you can modify previously declared data here;

For newly registered users, if you need to modify previously declared data, please contact your account manager or online customer survice.

If you need to correct previously submitted declarations (such as missing items or incorrect amounts), follow these steps:

Click the Add Data button.

When the blank data field appears, click the field or the Edit button to enter the edit page.

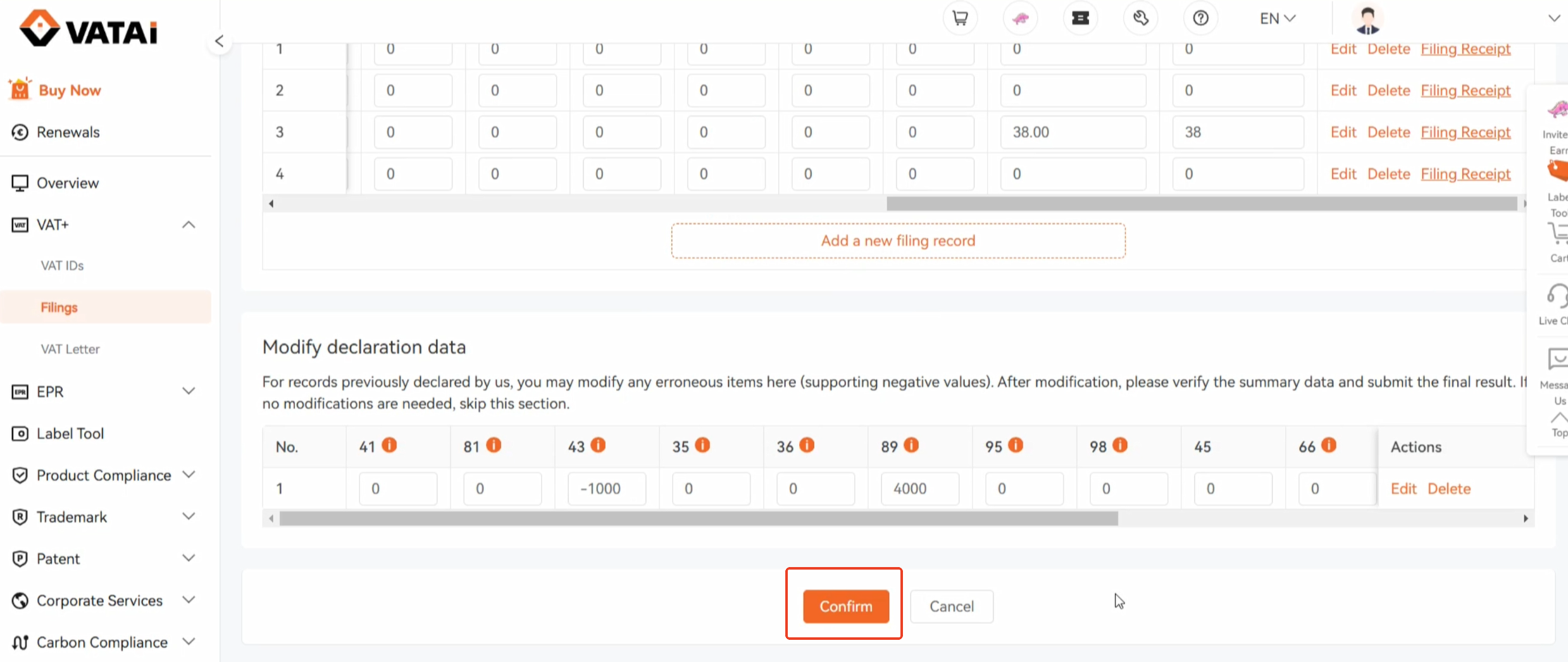

Input the correction values in the corresponding items:

For missing declarations: Enter the full amount;

For corrections: Enter the difference amount (use negative values for over-declarations);

For multiple corrections, input all modifications in their respective columns.

Finally, click Confirm to complete the modifications of the declaration data.

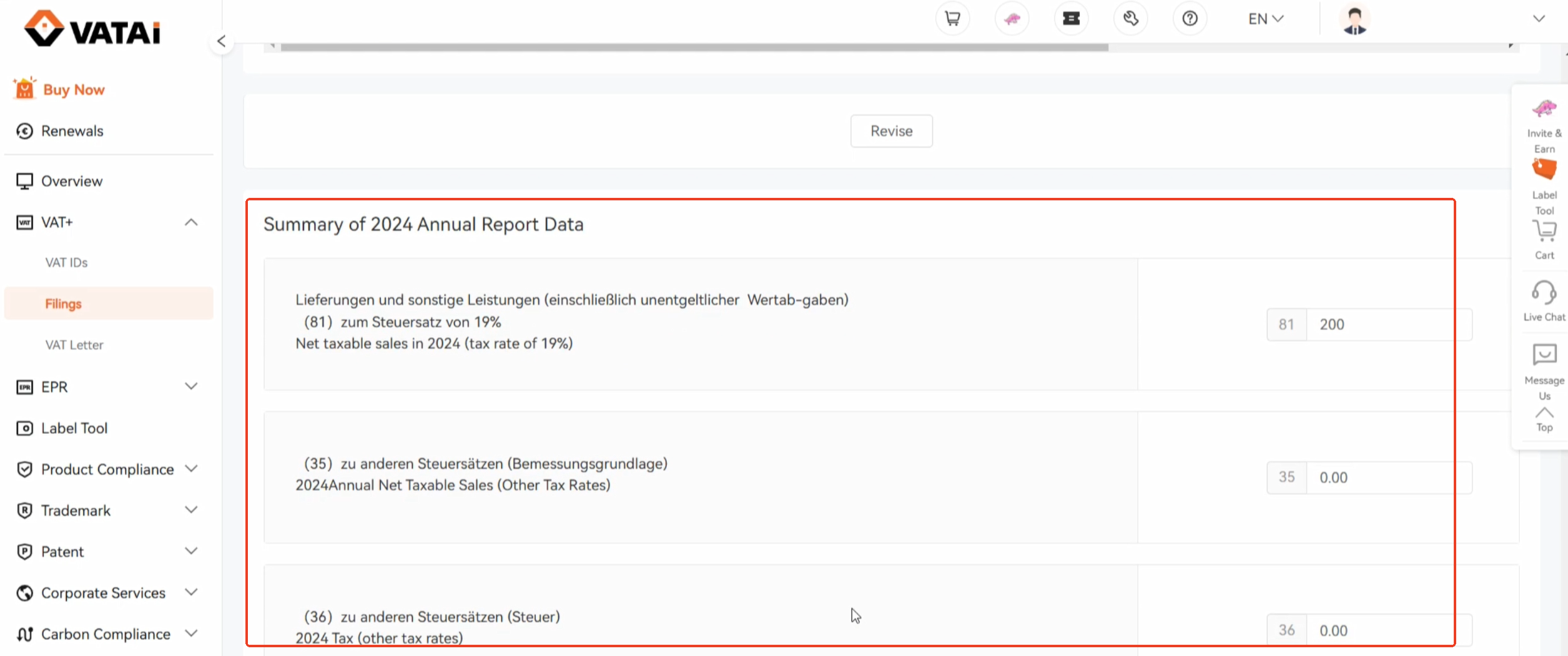

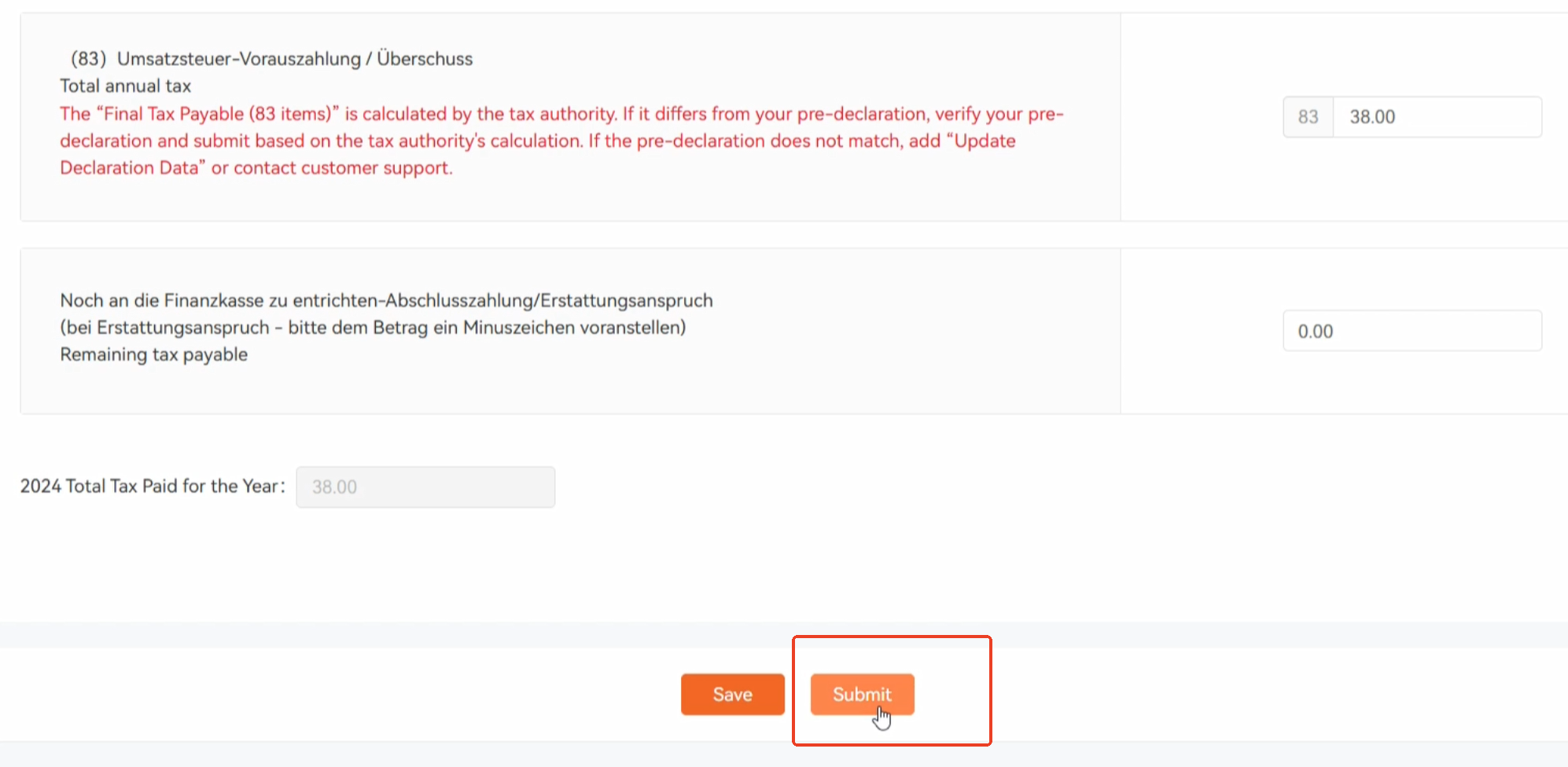

Step6: Final Review and Submission

After, clicking Confirm. The page will display a summary of the annual report data for 2024.

Please verify that each item in the annual report equals the total of the preliminary declarations for the entire year. Once confirmed, click Submit Declaration.

Need Help?

Book a free call with VATAi today to find tailored compliance solutions for your e-commerce business.