Spanish VAT: NIF vs. Intra-Community VAT

As Amazon Spain and the Spanish Tax Agency (AEAT) step up tax compliance enforcement, sellers are now required to upload a valid Spanish Intra-Community VAT number to Seller Central. This is achieved by registering in the Registro de Operadores Intracomunitarios (ROI). For any seller engaging in cross-border or Pan-EU activities, having only a domestic Spanish tax number (NIF) is not sufficient.

Sellers often ask:

- "I already have a Spanish NIF. Why does Amazon still require an Intra-Community VAT number?"

- "What triggers the need for cross-border VAT compliance in Spain?"

This guide clarifies the critical differences between the Spanish NIF and an activated Intra-Community VAT number, and outlines when and how to register.

Understanding the NIF: Spain's Domestic Tax ID

The NIF (Número de Identificación Fiscal) is the universal tax identification number in Spain, assigned to all businesses and individuals for domestic tax purposes.

- For Spanish citizens, the NIF is their national ID number (DNI).

- For foreign nationals residing in Spain, their Foreigner's Identity Number, the NIE (Número de Identidad de Extranjero), also serves as their NIF.

- For business entities, the NIF serves the function of the previously used Código de Identificación Fiscal (CIF). While the term "CIF" is still used colloquially, it was officially replaced by the NIF in 2008 for all legal entities.

The NIF is essential for any domestic financial transaction, issuing local invoices, and filing Spanish tax returns (like corporate tax or local VAT).

What is an Intra-Community VAT Number?

An Intra-Community VAT number is not a new or separate number. It is an activated status for your existing Spanish NIF, making it valid for cross-border B2B trade within the European Union.

This registration places your business in the ROI (Registro de Operadores Intracomunitarios), which is Spain's official register of intra-community operators. Your number then becomes verifiable in the EU-wide VIES (VAT Information Exchange System).

Its primary purpose is to facilitate the EU single market's VAT rules, enabling zero-rated (0% VAT) transactions between VAT-registered businesses in different EU member states.

The format is simple:

- Format:

ES+ Your Full NIF Number - Example (Company): If the NIF is

B12345678, the Intra-Community VAT number isESB12345678.

NIF vs. Intra-Community VAT Number: At a Glance

| Dimension | Spanish Domestic Tax Number (NIF) | Intra-Community VAT Number (VIES-valid) |

| Primary Purpose | Domestic taxation in Spain (corporate tax, local VAT filings) | EU cross-border B2B transactions and customs |

| Applicable Scope | Limited to transactions within Spain | B2B transactions between Spain and other EU member states |

| Format Structure | Varies (e.g., B12345678 for companies; X1234567A for individuals) | ES + NIF Number (e.g., ESB12345678) |

| System | Spanish Tax Agency (AEAT) internal system | Verifiable publicly in the EU VIES system |

Who Needs a Spanish Intra-Community VAT Number?

You must register for and obtain an active Spanish Intra-Community VAT number if your business:

- Stores goods in a Spanish warehouse (e.g., FBA) for sale to customers in other EU countries.

- Participates in Amazon’s Pan-European (Pan-EU) FBA program, using Spain as a storage country.

- Sells goods B2B from Spain to VAT-registered businesses located in other EU member states.

If you only sell goods from Spain to Spanish consumers (B2C) and do not engage in any cross-border B2B activity, a standard NIF is sufficient.

How to Check If You Are Registered in the ROI

- Go to the official EU VIES website: https://ec.europa.eu/taxation_customs/vies/

- Select Spain (ES) from the member state dropdown menu.

- Enter your complete NIF number (e.g., B12345678) in the "VAT Number" field.

- The system will confirm if your VAT number is valid for cross-border transactions within the EU. If it is, you are successfully registered in the ROI.

Can You Apply Without Existing EU Transactions?

Yes. Here are the two most accepted justifications:

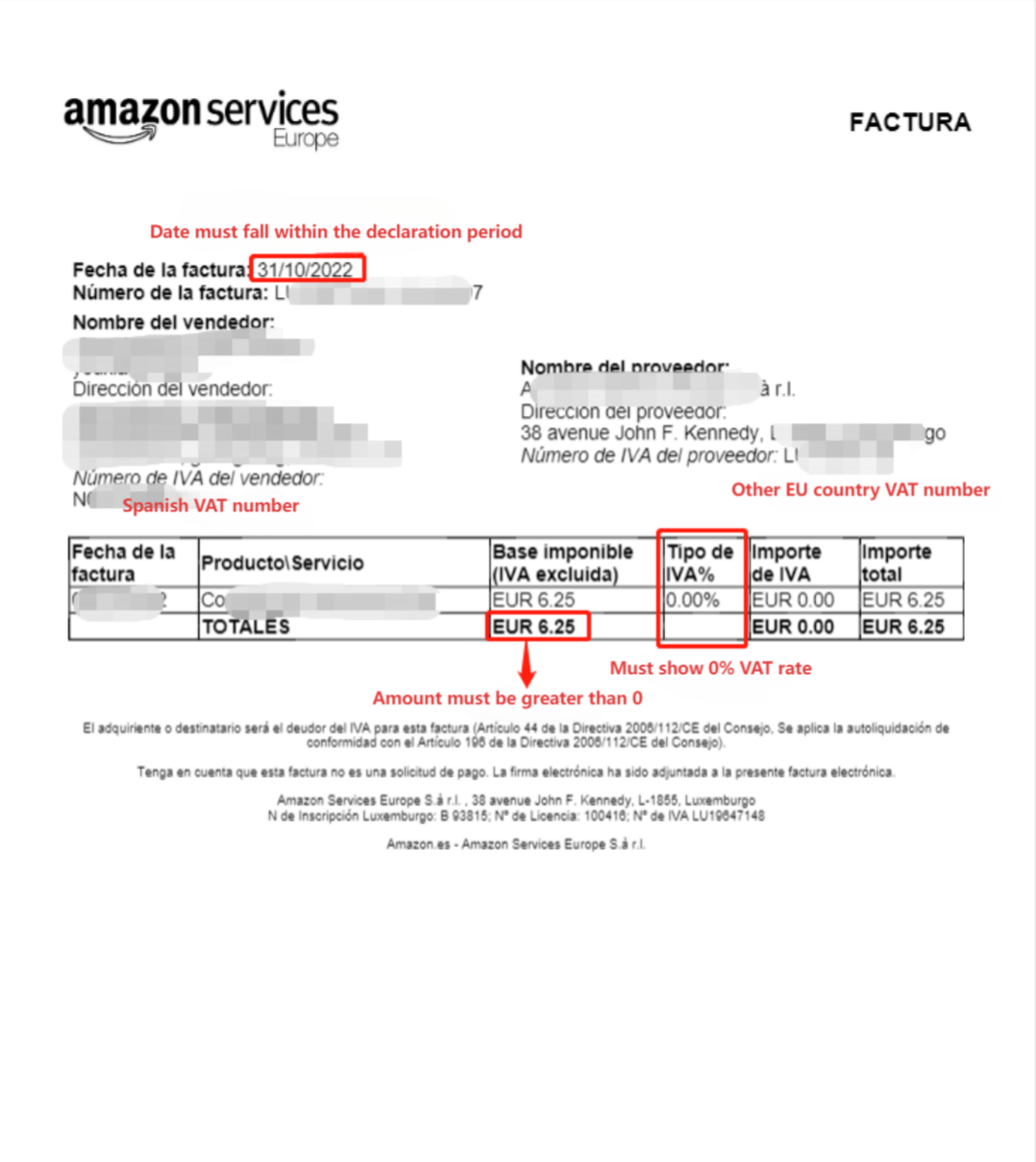

1.Amazon Luxembourg Invoices: These are issued for 0% VAT FBA service charges and indicate cross-border operations.

2. Voluntary B2B Transactions: You can initiate purchases or sales to/from EU VAT-registered companies to meet the registration requirement.

Important: B2B invoices must be reported via Modelo 349 before they can be used to apply.

How to Apply for a Spanish Intra-Community VAT Number?

Fill out Form 036, and mark:

- Box 582 – Request inclusion in the ROI.

- Box 584 – Estimated start date of intra-EU activity.

You can apply independently or through Amazon's SPN partners like VATAi.

Required Documents:

- Valid Spanish NIF

- Hague Apostille

- Supporting cross-border invoices

- EU VAT certificate from another country (optional)

- Proof of sales activity

- Platform shop link (must be tied to the NIF)

Once submitted, the AEAT may send a questionnaire letter to verify your business activities. Upon successful review, your number will be activated in VIES. The entire process generally takes 2–4 months.

Compliance Obligations After Activation

Once your Spanish Intra-Community VAT number is active:

- You must include both NIF and VAT numbers on all invoices.

- File Modelo 349 quarterly to report B2B intra-EU trade.

- Submit Modelo 303 for standard VAT returns.

- Maintain clear records for audits.

Failure to file Modelo 349 for two or more quarters may result in the deactivation of your VAT registration.

FAQs

Q1: What happens if I don't have an Intra-Community VAT number?

- You cannot legally conduct intra-EU B2B trade.

- Amazon may suspend FBA storage and cross-border functions.

- You’ll be forced to charge local VAT even on cross-border transactions.

Q2: Can I apply if my business license or Amazon account details changed?

Yes, but you must ensure all details are perfectly consistent across your application documents, tax records, and platform information to avoid rejection.

Q3: Do I still need to file Modelo 349 after registration?

Yes. Regular reporting is mandatory to maintain an active VAT status.

Registering for a Spanish Intra-Community VAT number is not optional for cross-border traders—it's a compliance must. Without it, sellers risk:

- Amazon account restrictions

- Lost access to Pan-EU benefits

- VAT compliance penalties.

Have VAT questions? Contact a VAT expert at VATAi to get started with your registration.

Need Help with VAT Compliance?

Book a free call with VATAi today to find tailored solutions for your e-commerce business