Expand Your Business with Amazon's Ireland VAT Promotion

Entering a new European market can be challenging, especially when it comes to tax compliance. In 2025, Amazon is making it easier for global sellers to expand to Amazon.ie with zero VAT setup costs. Through Amazon's Ireland VAT Reimbursement Promotion (check the full Terms & Conditions), sellers can receive up to €1,900 in reimbursements for VAT registration, two years of filing, and fiscal representation — when register through an official tax service provider like VATAi. This is a rare opportunity to grow your business in a high-potential e-commerce market, fully supported by Amazon.

Ireland: The Next Big Opportunity in EU E-Commerce

With the launch of Amazon.ie, Ireland is emerging as an attractive new e-commerce market in Europe. The country combines strong consumer purchasing power with a highly developed digital economy, making it well positioned for cross-border e-commerce growth. Ireland consistently ranks among the highest GDP per capita economies globally, with recent figures exceeding $107,000 in 2024, reflecting its role as a high-value commercial and business hub. At the same time, Irish consumers are highly engaged online, with over 90% of internet users regularly purchasing goods or services online, placing Ireland among the most digitally active markets in the EU. With widespread adoption of fast delivery options and Amazon FBA services, Ireland is particularly well suited for sellers looking to scale efficiently through localized fulfillment. By expanding to Ireland, sellers can leverage Amazon’s established infrastructure—including local FBA warehouses and optimized delivery networks—to reach a digitally savvy consumer base with strong demand for international and cross-border products.

What Is the Amazon Ireland VAT Promotion?

Amazon's Ireland VAT Promotion is designed to help sellers expand to Amazon.ie by reducing the upfront cost of VAT compliance in Ireland. Under this promotion, eligible sellers can receive a reimbursement of up to €1,900 (excluding VAT) to cover essential VAT-related services.

The promotion includes:

- Free VAT registration in Ireland

- Two years of free VAT filings

To qualify, sellers must register for VAT services through one of Amazon's officially designated Tax Advisers (such as VATAi), and meet Amazon's eligibility requirements.

The reimbursement is issued directly by Amazon, not by the tax service provider. Once Amazon has verified that all eligibility criteria are met, the reimbursed amount will be credited to the seller's Amazon Seller Central account and will appear as a “Miscellaneous Adjustment” in the payment records.

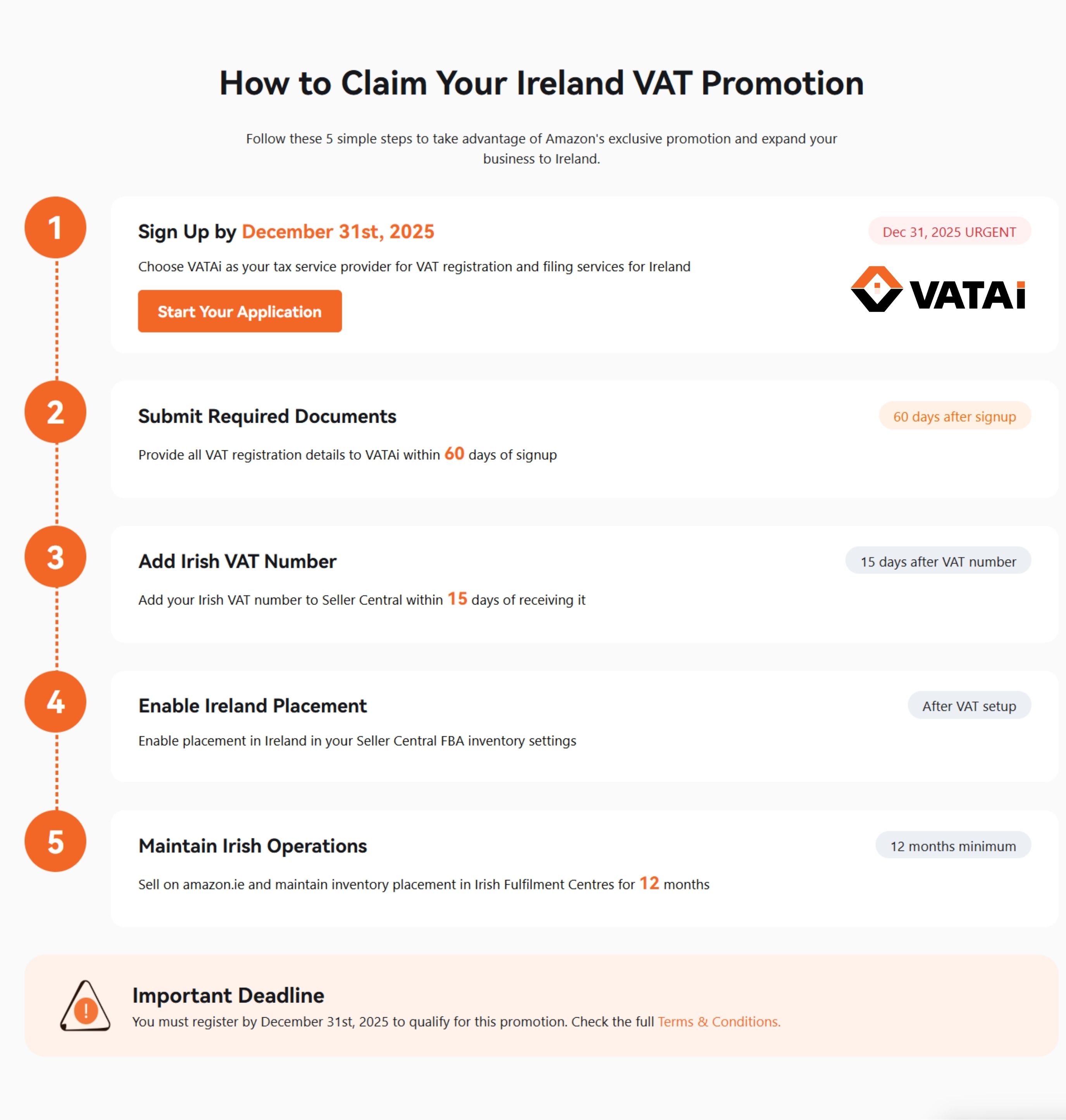

How Does The Amazon.ie Promotion Work? (Step-by-Step)

- Order VAT Registration Services: Sign up for VAT registration and filing services through one of Amazon's designated Tax Advisers and provide all required information and documents.

- Submit Your Seller ID: Share your Amazon.ie seller ID for verification.

- Activate Your Inventory: Enable Irish inventory storage in your Seller Central account through "Amazon Logistics Inventory Settings" and ensure your products are sale-ready.

- Upload Your VAT Number: Once you receive your VAT number, upload it to your Amazon Seller Central account within 15 days.

- Wait for Your Reimbursement: After Amazon verifies your inventory activation, the Reimbursement will be credited to your seller account within 1–3 months. You can track the reimbursement as a "Miscellaneous Adjustment" under Seller Central > Reports > Fulfillment by Amazon > Payments > Reimbursements.

By following these steps, you can expand your business in the Irish market while enjoying the benefits of Amazon's VAT reimbursement program.

Note on reimbursement timing

According to Amazon's official terms, the reimbursement is processed within up to 3 months after the Irish VAT number has been successfully added in Seller Central, subject to Amazon's eligibility verification and internal payout schedule. As a result, there is no fixed end-to-end timeline from service purchase to reimbursement, as this depends on both the VAT registration timeline and Amazon's verification. For more information, please contact your account manager or schedule a free consultation with our team.

Eligibility for the Reimbursement

- Ensure your Amazon.ie store hasn't upload an Irish VAT number by January 1, 2025.

- Register for Irish VAT through VATAi and activate inventory storage in Ireland by December 31, 2025.

- Enable inventory storage in Ireland and ensure products are sale-ready on Amazon.ie. (At least one active, sellable FBA listing on Amazon.ie)

- Provide all required information and documents to the Tax Adviser within 60 days of signing up for their services.

- Enter the VAT number for Ireland in their Seller Central account within 15 days of receiving it from the Tax Adviser.

- Maintain active inventory storage in Ireland for at least 12 months to avoid any clawbacks of the reimbursement.

Please note: Final reimbursement approval and timing are determined by Amazon, following its verification process.

Get Started Today with VATAi

Don't let the complexities of VAT registration hold you back from tapping into the Irish market. With VATAi and Amazon's promotion program, you can register for Irish VAT, expand your business, and enjoy two years of VAT compliance at no cost.

Ready to grow your business in Ireland? Get your Irish VAT registration with VATAi today and take the first step toward success on Amazon.ie. More details at www.vatai.com/expand-to-ireland.

Need Help with VAT Compliance?

Book a free call with VATAi today to find tailored solutions for your e-commerce business