Breakthrough in Legal Fight Over Italy's €50,000 VAT Guarantee: Sellers Win Procedural Victory

As cross-border e-commerce accelerates, the EU regulatory environment has become increasingly complex—especially for non-EU sellers navigating evolving compliance obligations. A recent VAT policy in Italy has brought this tension to the forefront.

In 2024, Italy introduced a requirement mandating all non-EU sellers registering for VAT via a fiscal representative to provide a €50,000 financial guarantee to retain VIES status—essential for conducting intra-EU transactions. The policy sparked immediate concern due to its high financial threshold, unclear implementation, and broad, uniform application. Many small and mid-sized sellers, along with service providers, were left uncertain and unprepared.

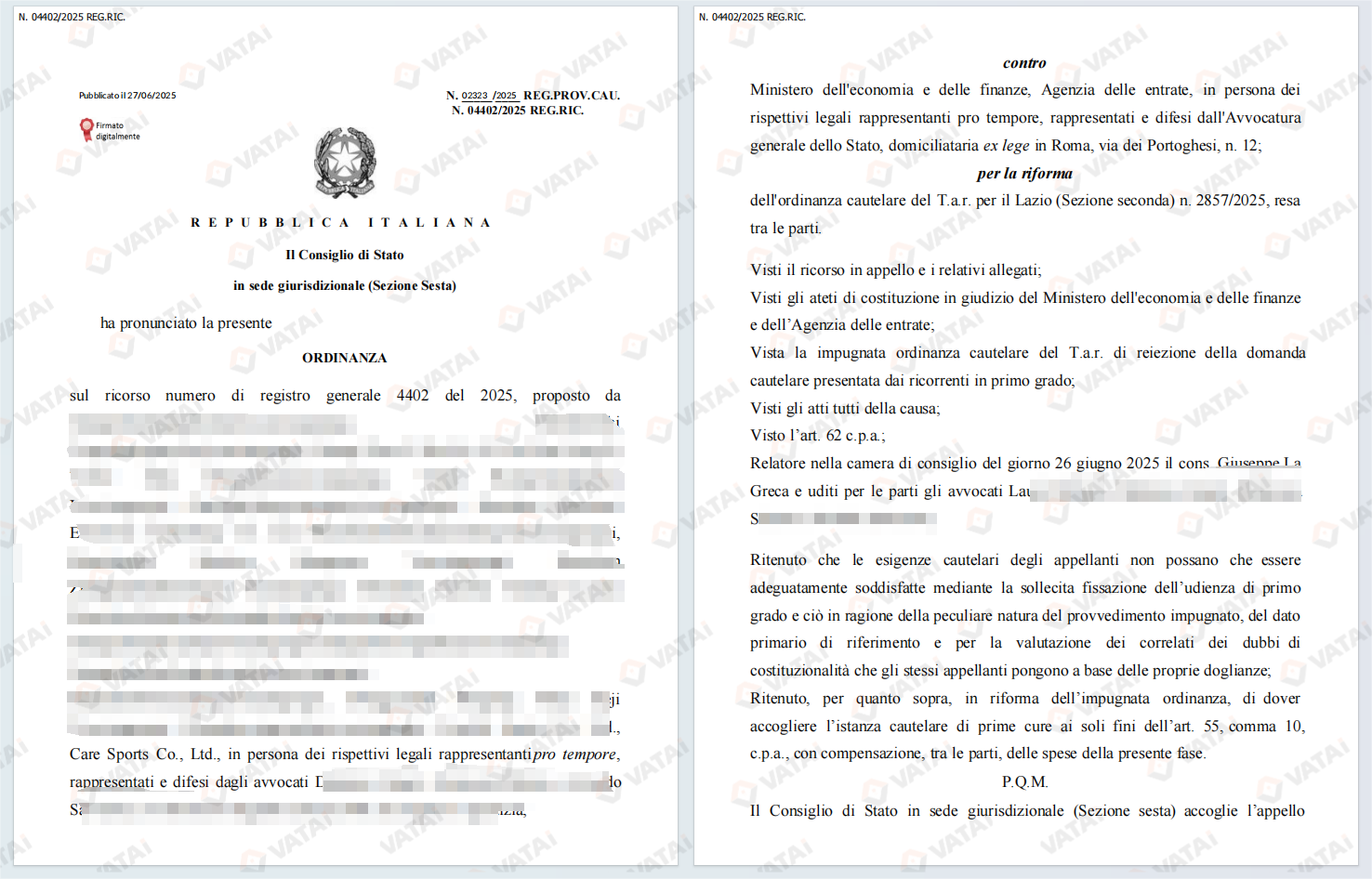

In response, VATAi Global Group, together with dozens of e-commerce sellers, filed an administrative lawsuit challenging the policy's legality. Although the case was initially dismissed in May 2025, VATAi and its partner sellers appealed. On June 27, 2025, Italy's Council of State (Consiglio di Stato) ruled that the case must return to the regional court for formal hearing and review. This marks a procedural but significant legal breakthrough in an effort to contest the proportionality and legality of the policy.

Background - Understanding the Italian VAT Guarantee Requirement

In early 2024, the Italian Ministry of Economy and Finance introduced new VAT compliance measures aimed at curbing VAT fraud. One of the key components was a mandatory financial guarantee for:

- Non-EU and non-EEA sellers registering for Italian VAT via a fiscal representative, set at a minimum of €50,000 for VIES registration.

- Fiscal representatives themselves, ranging from €30,000 to €2 million based on client volume.

The rule, formalized through a series of decrees from February to April 2024, was set to take effect for existing VIES-registered sellers by June 13, 2025, with enforcement follow-ups beginning in August.

The policy has raised concerns across the industry for imposing disproportionate financial and administrative burdens on sellers, regardless of their size or risk profile.

For a detailed breakdown of the policy, please read our blog post:Italy's New VAT Guarantee Requirement for Non-EU Businesses

Legal Timeline - From Rejection to Reconsideration

The legal effort, led by VATAi Global Group, began shortly after the rule was announced. A coalition of sellers joined the suit to challenge the regulation through Italy’s administrative court system.

- May 21, 2025: The Regional Administrative Court (TAR Lazio) rejected the initial appeal.

- June 27, 2025: The Council of State overturned the dismissal, citing the need for a full substantive hearing.

The appellate court ruled that the first-instance court had failed to properly examine the constitutional and proportional aspects of the regulation. The case will now return to TAR Lazio for a full review, with a hearing expected in Q4 2025.

Key Takeaways from the Ruling

The decision by the Council of State does not invalidate the €50,000 guarantee policy. However, it provides several important implications:

- The court accepted the our request for procedural relief and ordered the first-instance court to prioritize a formal hearing.

- The policy must now be examined under full legal scrutiny, including questions of proportionality, fairness, and potential constitutional concerns.

- Until the lower court issues a new ruling, the enforcement of the policy remains uncertain and potentially subject to delay or modification.

VATAi Global Group’s Role and Continued Advocacy

This legal milestone would not have been possible without coordinated action, seller collaboration, and financial investment. VATAi Global Group has:

- Initiated and led the only formal legal case challenging the regulation;

- Worked with dozens of sellers to submit legal documentation and testimony;

- Secured more than €2million in bank guarantees to ensure compliance continuity;

- Engaged with Italian lawyers, institutions, and platforms to ensure ongoing protection for seller accounts.

"We are not bystanders — we stand with sellers on the front lines, taking action and advocating for fairer compliance."

VATAi Global Group remains committed to supporting sellers affected by this policy and to seeking fairer, risk-based solutions that preserve cross-border e-commerce access to the Italian and broader EU market.

What Will Happen Next?

With the case remanded to TAR Lazio, a new hearing must now be scheduled—expected between Q3 and Q4 2025. Legal experts suggest several possible outcomes, including:

- Revision of the guarantee policy with tiered thresholds based on sales or risk;

- Exemptions for small and low-volume sellers;

- Continued enforcement for high-risk or high-volume sellers only;

- Rejection of the appeal, although current judicial signals suggest otherwise.

Recommendations for Sellers

Given the current status of the policy, sellers are advised to:

- Delay the submission of new guarantees if not currently required by platform or representative;

- Maintain access to bank guarantee channels in case of future enforcement;

- New applicants for Italian VAT: evaluate OSS (One-Stop Shop) registration alternatives for limited-volume sales into Italy;

- Monitor updates closely and seek professional advice to remain compliant.

Final Thoughts

This procedural win does not mark the end of the dispute, but it does represent a meaningful shift in momentum. For the first time, the legal system has acknowledged that the seller community deserves a substantive review of this impactful policy. VATAi will continue to provide regular updates and work with all stakeholders—sellers, platforms, and legal authorities—to ensure compliance pathways remain accessible, fair, and sustainable for cross-border businesses.

For further updates or support, please reach out to your account manager or email us at info@vatai.com or support@vatai.com.